Consolidation is the quiet phase between strong market moves. Prices trade sideways, volatility contracts, and traders wait for the next breakout. For day and swing traders, understanding consolidation is essential: it helps avoid low-probability trades, time reversals accurately, and catch early breakouts when momentum returns.

This guide explains how to identify consolidation on the daily chart and intraday timeframes, which strategies work best inside ranges, and how to size and manage positions with stop-loss, take-profit, and trailing stops. Real-market examples include forex (GBP/USD), commodities (gold), and cryptocurrencies (SOLUSD, XRPUSD).

1) What Is Consolidation?

Definition: Consolidation is a sideways movement in price where neither buyers nor sellers dominate. The market trades within clear boundaries – support and resistance – while volatility and volume decline. It often occurs after a strong trend or before important economic data.

Key characteristics:

- Defined range: several touches on horizontal highs and lows without sustained breakouts.

- Volatility compression: a shrinking ATR(14) or narrowing Bollinger Bands.

- Flattened moving averages: 20–50-period MAs move sideways through price.

- Low ADX readings: below 20 usually signals weak trend strength.

Recognising consolidation matters because most markets spend over half their time in ranges. Trading a range as if it were a trend often leads to unnecessary losses.

2) How to Identify Consolidation on the Daily Chart

- Mark support and resistance. Highlight the highs and lows of the last 10–40 sessions where price repeatedly reverses.

- Add a buffer. Extend your range by 0.25–0.5× ATR(14) to account for false wicks and volatility spikes.

- Draw a midline. This can be a 20-period SMA or an anchored VWAP – a common target for mean-reversion trades.

- Check the calendar. Identify macro or crypto-specific events (CPI, NFP, token unlocks) that could trigger a breakout.

3) Trading Strategies for Consolidation

A) Mean-Reversion Inside the Range

Best for mature ranges (at least three touches per side) with low volatility and no imminent news.

Entry: Fade price near support or resistance using reversal patterns such as pin bars, engulfing candles, or RSI divergence.

Stop-loss: Beyond the range edge by 0.3–0.5× ATR(14).

Take-profit: First target at the midline, second at the opposite side of the box.

Position sizing: Limit risk to 0.5–1% of account equity.

Tips:

- Because the bid/ask spread becomes significant in tight ranges, use limit orders instead of market orders.

- Trailing stops are not effective inside ranges; fixed targets usually perform better.

B) Breakout from the Range

Best for setups with contracting volatility, rising volume, or an upcoming catalyst.

Entry: Enter on a confirmed close beyond resistance (for longs) or support (for shorts). Consider a stop-limit order to reduce slippage.

Stop-loss: Just inside the broken boundary (0.2–0.4× ATR(14)).

Trade management: Once price moves at least 1× ATR(14) in your favour, switch to a trailing stop (ATR-based or Chandelier Exit) to let profits run.

Fakeouts: If price briefly breaks out and then returns into the range, a counter-trade can be taken in the opposite direction with a tight stop beyond the fakeout wick.

4) Day vs Swing Trading Applications

Day Trading Strategy

- Define the opening range (first 30–60 minutes) and treat it as a micro-consolidation zone.

- Trade from one edge to another, avoiding the centre of the range.

- Use VWAP and previous session highs/lows as reference points.

- Close all trades by the end of the session to avoid overnight gaps and funding costs.

Swing Trading Strategy

- Identify the range on the daily chart, then drop to H1 or H4 for entry signals.

- Inside the box, aim for 2:1 reward-to-risk (R-multiple) trades.

- For confirmed breakouts, trail stops 1–3× ATR(14) below (long) or above (short) price.

5) Order Execution and Trading Costs

- Bid/ask spread: Avoid trading thin markets (e.g., exotic FX pairs or low-liquidity crypto) during consolidation.

- Order types: Limit or stop-limit orders are best for precise entries.

- Slippage: Common during data releases – reduce size or stand aside.

- Long and short positions: Trade both directions; stay flexible.

6) Managing Risk and Rewards

Stop-loss: Beyond range edges plus an ATR buffer.

Take-profit: At the midline and opposite edge for range trades; at measured-move levels for breakouts.

Trailing stop:

- Inside ranges – fixed stop.

- Post-breakout – use Chandelier Exit or ATR trailing method.

7) Practical Examples

Forex – GBP/USD: A four-week sideways range near 1.2600–1.2800. Traders faded upper resistance with bearish candles on H4, placing stops 0.4× ATR beyond the highs. Once UK CPI data broke the range, re-entries on pullbacks captured the breakout trend.

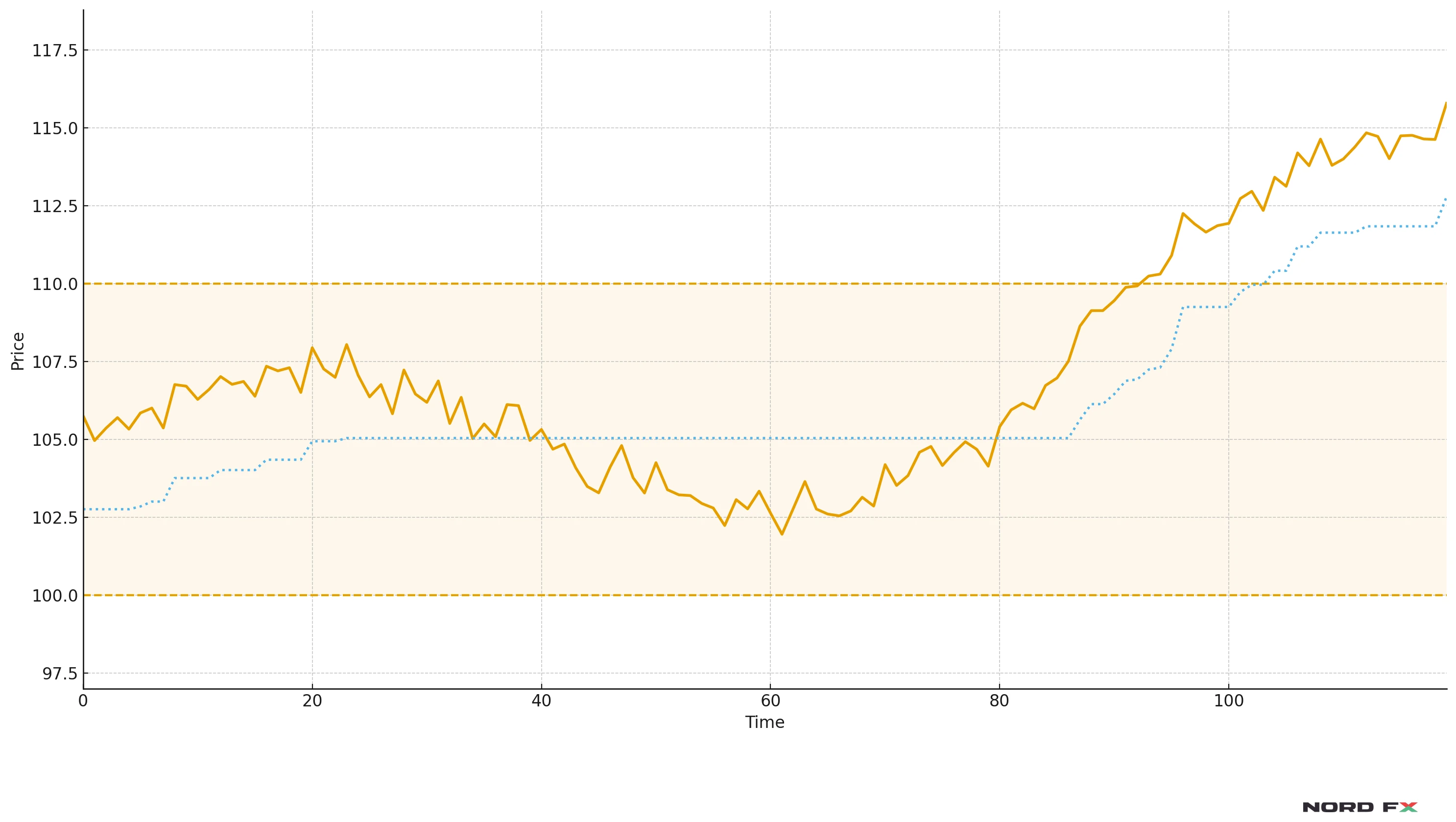

Commodities – Gold (XAUUSD): After a strong rally, gold formed a flag-like rectangle. A daily close above the upper edge triggered a breakout; trailing stops 3× ATR below the highs protected profits as gold reached new records.

Crypto – SOLUSD and XRPUSD: Weekend trading often shows consolidation due to thinner liquidity. Range edges offer opportunities for limit entries; confirmation of breakout comes only after a 4-hour close beyond the box with increasing volume.

8) Position Sizing Principles

Always decide your position sizing and risk first. For example, risking 1% of a £10,000 account means £100 per trade. If your stop is 50 pips, each pip equals £2 – so your position size is 2 micro-lots.

Formula:

Position Size = (Account Risk) ÷ (Stop Distance × Pip Value)

Adjust risk lower for illiquid assets or ahead of major news events.

9) Trader’s Checklist

Before placing any trade, review this quick checklist:

- The range is clearly defined on the daily chart, with at least three confirmed touches on each side.

- An ATR buffer (0.25–0.5×) is added beyond the support and resistance lines.

- The strategy is chosen – mean-reversion or breakout – never both simultaneously.

- A clear entry trigger is confirmed (price action or indicator signal).

- Order type selected appropriately: limit or stop-limit for precision entries.

- Risk percentage and position size are calculated in advance.

- Stop-loss, take-profit, and (if applicable) trailing stop are set.

- The economic calendar and crypto events are checked to avoid major announcements.

- Trade costs reviewed: bid/ask spread, slippage, and overnight fees.

- Mental checklist: stay neutral, follow plan, and avoid impulsive switching.

10) Common Mistakes

- Trading in the middle of the range where probability is lowest.

- Entering breakouts before candle close confirmation.

- Ignoring spread, slippage, or funding costs.

- Switching bias mid-trade without a clear signal.

11) Quick Glossary

Consolidation: Sideways market movement within defined boundaries.

Bid/Ask: The best available sell/buy prices; their difference is the spread.

Long/Short: Positions that profit from rising/falling prices.

Stop-loss / Take-profit: Automatic exit orders at pre-set loss or profit levels.

Trailing stop: A dynamic stop that follows price to lock in profits.

ATR (Average True Range): Indicator measuring volatility; useful for setting stops.

Chandelier Exit: Trailing stop placed a multiple of ATR from the highest high or lowest low.

VWAP (Volume-Weighted Average Price): Reflects the average price weighted by volume – often acts as a mid-range magnet.

R-multiple: Reward-to-risk ratio used to measure trade efficiency.

12) Frequently Asked Questions

Q: How long can a consolidation last?

A: Anywhere from a few sessions to several months. The longer the range, the stronger the eventual breakout tends to be.

Q: Is a trailing stop useful inside a range?

A: Not really. Fixed stops and clear profit targets work better until a breakout occurs.

Q: How can I avoid false breakouts?

A: Wait for a candle close beyond the range, confirm with volume, and check higher-timeframe alignment.

Q: Does consolidation happen in crypto too?

A: Yes – often during weekends or low-liquidity periods. Watch SOLUSD, XRPUSD, and similar pairs for breakout setups.

Final Thought

Consolidation is not wasted time – it’s where markets recharge for the next big move. By combining disciplined position sizing, clear range mapping, and structured exit plans with stop-loss, take-profit, and trailing stops, traders can turn quiet markets into consistent opportunities.