General Outlook of the Past and Coming Week

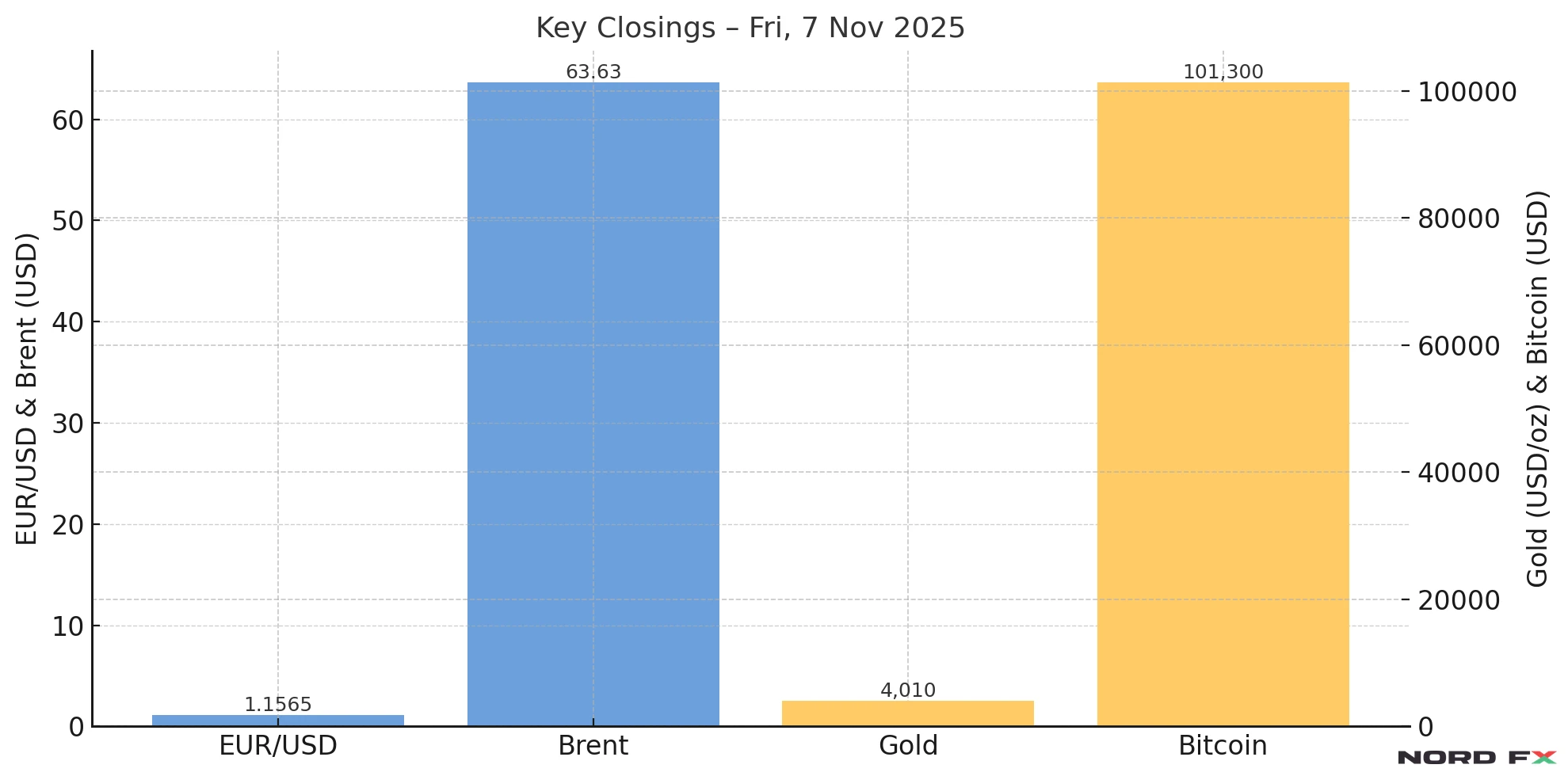

Markets ended the week with a cautious tone as the US dollar softened modestly and traders turned their focus to the upcoming October inflation data. Brent crude closed near US$ 63.7 per barrel, gold settled at US$ 4 009.80 per ounce, and bitcoin hovered around US$ 103 300. Equity volatility eased slightly, though cross-asset flows still show investors waiting for clearer policy guidance. Liquidity will be reduced on Tuesday due to the US Veterans Day holiday, while Thursday’s CPI and Friday’s PPI releases are expected to set the tone for markets through mid-November.

EUR/USD

The pair closed the week near 1.1566, consolidating after a moderate advance. On the daily chart, the euro remains supported above its 50-day moving average, though momentum indicators point to waning strength. The pair continues to trade within a medium-term Triangle pattern, with buyers defending the 1.1490–1.1520 area. A move toward 1.1720–1.1730 early in the week remains possible, but the RSI is approaching a descending resistance line, suggesting that upside could be limited before another correction. A break below 1.1490 would expose 1.1365, while a daily close above 1.2060 would confirm a breakout and open the way to 1.23.

Baseline view: mild bullish bias while above 1.1490, though corrective dips from the 1.17 zone are possible if CPI data strengthens the dollar.

Bitcoin (BTC/USD)

bitcoin finished the week around US$ 103 300, remaining in a correction after its October rally. Moving averages still point upward, yet the coin struggles to regain its previous bullish momentum. Resistance lies near US$ 105 000–106 000, where renewed selling could emerge if the RSI fails to clear its mid-range barrier. A fall below US$ 98 000 could extend losses toward US$ 95 000–92 000, while a firm breakout above US$ 115 000 would restore bullish control and target US$ 125 000.

Baseline view: neutral-to-slightly bullish while above US$ 98 000, with volatility likely to increase after the US CPI announcement.

Brent Crude Oil

Brent futures closed at US$ 63.7 per barrel, remaining in a broad descending channel with sellers dominant below US$ 65. A short-term correction toward US$ 65.5–66.5 cannot be excluded, but momentum indicators such as the RSI stay subdued, implying limited upside potential. A decline and close below US$ 62.0–61.5 would confirm renewed bearish pressure with targets around US$ 58, while sustained trade above US$ 70–71 would mark a reversal of the downtrend.

Baseline view: neutral-to-bearish below US$ 65, with sellers retaining control unless price holds firmly above that level.

Gold (XAU/USD)

Gold futures settled at US$ 4 009.80 per ounce, maintaining an uptrend inside a broad ascending channel. Momentum remains positive, though short-term corrections are possible as the metal nears overbought territory. A pullback toward US$ 3 865–3 900 would likely attract new buyers rather than alter the overall bullish structure. A close above US$ 4 075–4 165 would confirm a continuation of the rally toward US$ 4 200 and beyond, while a move below US$ 3 535 would invalidate the medium-term bullish scenario.

Baseline view: buy dips while above US$ 3 905, keeping an eye on potential volatility swings around CPI and PPI data.

Conclusion

The coming week’s direction will hinge on US inflation figures. Softer CPI results could pressure the dollar and support gold, oil, and risk assets, while stronger data may boost the greenback and limit upside elsewhere. Market activity is expected to stay muted early in the week and pick up sharply from Thursday as key data releases approach. Traders should remain flexible and monitor the technical levels outlined above.

NordFX Analytical Group

Disclaimer: These materials are not investment recommendations or trading guidance. They are provided for informational purposes only. Trading on financial markets carries risk and may result in the complete loss of deposited funds.

Go Back Go Back