The past week saw significant movements across major Forex and cryptocurrency pairs, reflecting broader market trends influenced by ongoing economic uncertainties and geopolitical factors. While the Euro and gold demonstrated correction and consolidation within familiar patterns, bitcoin exhibited strength within its bullish trajectory. The coming week promises to bring further volatility as markets react to evolving economic data and sentiment shifts.

EUR/USD

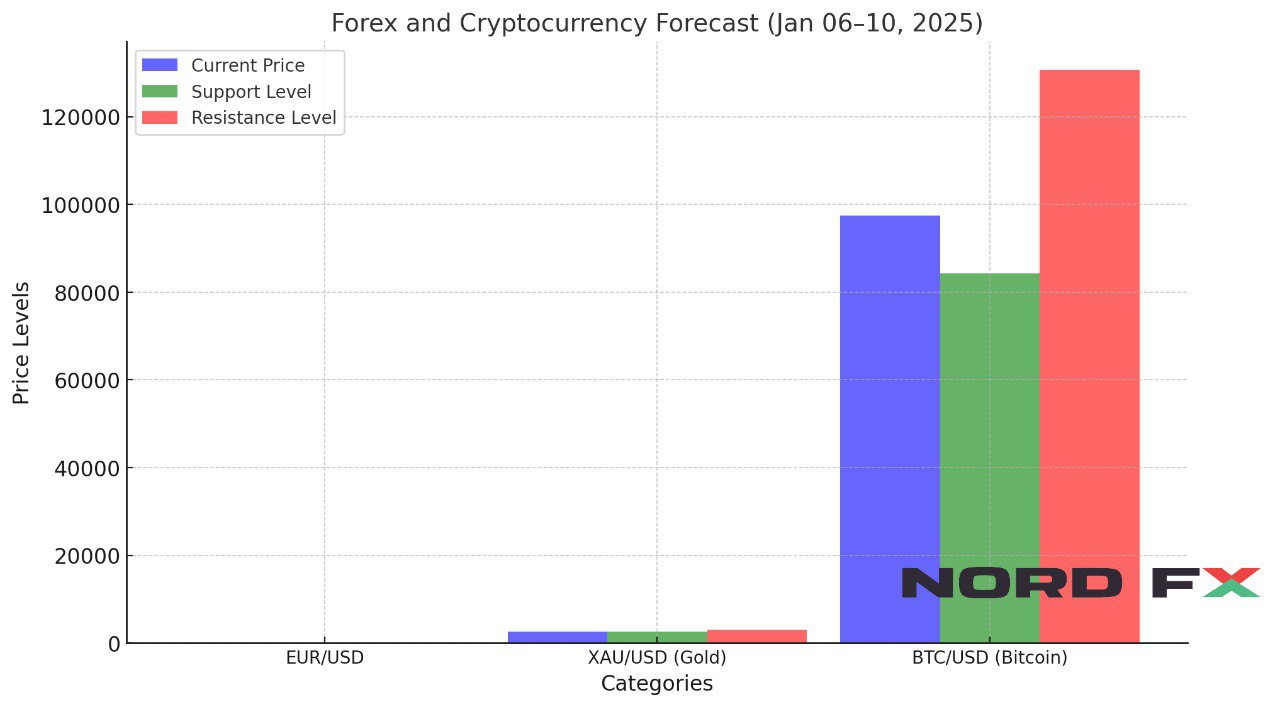

The EUR/USD pair concluded the week near 1.0282, moving within a well-defined descending channel. Bearish momentum remains dominant, with moving averages confirming a downtrend. Selling pressure is evident as prices have broken below key signal lines, hinting at a potential test of support near 1.0195 in the coming week. Following this decline, an upward rebound is anticipated, potentially propelling the pair toward the 1.0545 level.

Additional confirmation of this rebound could come from a test of the relative strength indicator (RSI) support line, accompanied by price support in the lower channel range. However, a break below 1.0045 would invalidate the bullish outlook, suggesting further declines toward 0.9805. Traders should monitor the pair’s behaviour around these critical levels, as a breakout above 1.0545 would signal a resumption of upward momentum and a breach of the descending channel.

XAU/USD (Gold)

Gold closed the previous week with a modest rise, ending near 2645, while continuing to trade within a corrective triangle formation. The overall trend remains bullish, as evidenced by moving averages, which reflect ongoing buyer support. In the short term, a decline toward the 2625 support level may precede an upward rebound, targeting 2975 as a potential high.

The RSI trend line and the lower boundary of the triangle pattern provide additional signals supporting the bullish forecast. A break below 2485 would invalidate this scenario, indicating a continuation of the downtrend toward 2415. Conversely, a confirmed breakout above 2755 would signal the completion of the triangle pattern, paving the way for a sustained move higher toward new highs.

BTC/USD (Bitcoin)

Bitcoin continues to consolidate its position within a bullish channel, closing the week at 97,438. The cryptocurrency's upward momentum is supported by strong buying activity, as prices remain above key moving averages. However, a short-term correction could lead to a test of support near 84,305. From this level, a rebound is likely to propel bitcoin toward the 130,635 mark.

The lower boundary of the bullish channel and the RSI support line provide additional backing for this optimistic outlook. A fall below 80,205, however, would invalidate the bullish scenario and suggest a deeper correction toward 65,605. A breakout above 105,005 would confirm continued bullish momentum and likely attract further buyer interest.

The upcoming trading week presents a mix of potential corrections and trend continuations across Forex and cryptocurrency markets. The EUR/USD pair is poised for a rebound following a test of lower support levels, while gold is expected to sustain its bullish trend within its triangle pattern. Bitcoin remains on a bullish trajectory, with its correction phases offering opportunities for renewed growth. Traders should closely monitor key support and resistance levels for actionable insights and confirmatory signals in a highly dynamic market environment.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.