The cryptocurrency market is built not only on price movements and trading strategies, but also on technical standards that determine how digital assets are created, transferred and stored. One of the most important of these standards is ERC20.

Many market participants trade Ethereum-based tokens without paying attention to what stands behind the ERC20 label. However, token standards have practical implications for trading, affecting liquidity, wallet compatibility, transaction costs and operational risk.

If you are new to crypto markets and want a broader overview of how cryptocurrency trading works, you may find it helpful to start with NordFX’s guide: Bitcoin and Other Cryptocurrencies.

This article explains what ERC20 tokens are, how they work, and why they matter for anyone involved in cryptocurrency trading.

What Is ERC20?

ERC20 is a technical standard used for creating and issuing tokens on the Ethereum blockchain. The name comes from Ethereum Request for Comment 20, a proposal that introduced a common set of rules for Ethereum-based tokens.

In practice, ERC20 defines how tokens behave within the Ethereum ecosystem. It specifies how tokens are transferred between users, how balances are checked, how total supply is calculated and how smart contracts interact with the token.

Because all ERC20 tokens follow the same rules, they can be integrated into wallets, exchanges and decentralised applications without the need for a unique technical setup for each token.

How ERC20 Tokens Work

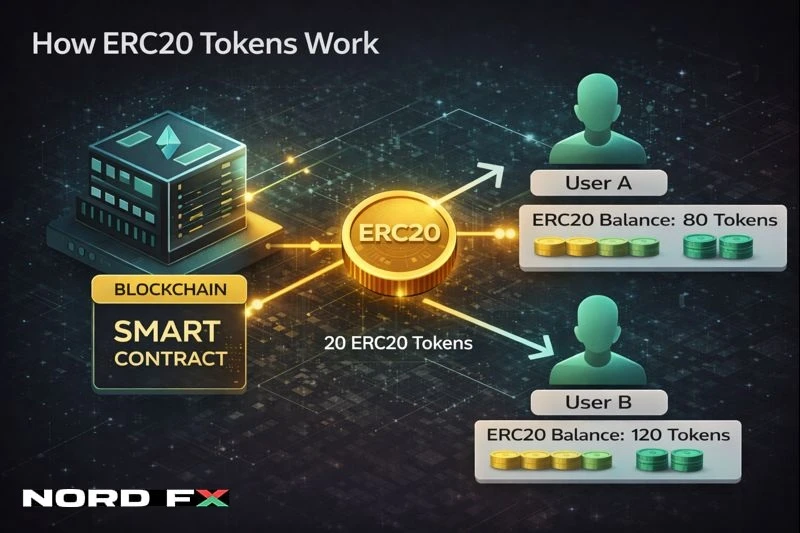

ERC20 tokens operate through smart contracts deployed on the Ethereum blockchain. A smart contract is a piece of code that automatically executes predefined rules when certain conditions are met.

Each ERC20 smart contract includes a set of standard functions. These typically cover token transfers between addresses, approvals that allow a third party to spend tokens on the holder’s behalf, and the ability to verify balances and supply.

If you want a deeper explanation of smart contracts themselves, NordFX has a separate article covering the concept and risks in detail: What Is a Smart Contract – Definition, How It Works, and Use Cases.

For traders, the standardisation behind ERC20 means that many different tokens can be handled in a similar way across compatible services, reducing technical friction.

Why ERC20 Became the Dominant Token Standard

ERC20 became the dominant token standard due to its simplicity, flexibility and early adoption within Ethereum’s ecosystem.

In Ethereum’s early growth phase, ERC20 provided projects with a practical framework for launching tokens without building blockchain infrastructure from scratch. As adoption expanded, exchanges and wallet providers gained an incentive to support the standard broadly, which increased liquidity and strengthened the ecosystem further.

As a result, ERC20 became a foundation for the expansion of token markets and later for decentralised finance applications.

Why ERC20 Tokens Matter for Crypto Traders

For crypto traders, ERC20 is not just a technical label. It affects trading conditions and operational safety in several ways.

Liquidity and Market Access

Many ERC20 tokens are supported by major centralised and decentralised exchanges. Broad infrastructure support often contributes to stronger liquidity and more stable order execution compared with assets that rely on less widely supported standards.

Liquidity conditions can also be analysed using market microstructure tools. For a practical explanation of how liquidity appears in trading interfaces, see: How to Use Market Depth in Forex, Crypto, and Stock Trading.

Wallet Compatibility

Most mainstream wallets support ERC20 tokens by default. This reduces the risk of a token being incompatible with basic wallet software and simplifies portfolio management for traders who hold multiple Ethereum-based assets.

That said, operational errors remain possible if a trader uses the wrong network or misunderstands token standards during transfers.

Integration with DeFi

ERC20 tokens play a central role in decentralised finance. Many DeFi applications - including decentralised exchanges, lending systems and liquidity pools - rely on ERC20 assets as their core building blocks.

If you want broader context about DeFi ecosystems and blockchain-based smart contract platforms, you can cross-reference NordFX’s article: Cardano, Solana, and DeFi: Smart Contracts Explained.

Market Transparency and On-Chain Behaviour

Ethereum transactions are recorded publicly, and ERC20 transfers are visible on-chain. This transparency can help traders observe token movements, monitor distribution patterns and study activity during periods of volatility.

ERC20 and Trading Risks

ERC20 tokens offer practical advantages, but they also come with risks that traders should understand.

Network Congestion and Fees

Ethereum transaction fees can rise sharply during periods of strong market activity. For active traders who frequently move funds, high fees can influence strategy decisions and reduce net profitability.

Smart Contract Vulnerabilities

ERC20 tokens are governed by smart contract code, and poorly written or unaudited contracts can expose holders to technical risks. These risks may include exploits, unintended token behaviour, or restrictions that affect transfers and access.

The most realistic approach for traders is to treat unfamiliar tokens as higher-risk assets, especially when there is limited technical documentation or unclear governance.

Operational Errors During Transfers

One of the most common mistakes in crypto is transferring tokens using the wrong network or depositing to an address that is not compatible with the asset’s standard. ERC20 tokens should be handled as Ethereum-based assets unless explicitly supported via other networks and bridges.

For traders who want a practical, platform-level overview of trading and settlement workflows, NordFX also offers: How to Buy Crypto Pairs Like BNBUSD and SOLUSD: A Beginner’s Guide.

ERC20 vs Other Token Standards

Although ERC20 is the most widely used Ethereum token standard, it is not the only one.

Ethereum also supports standards such as ERC721 and ERC1155, which are commonly used for NFTs and multi-token assets. Other blockchains use different standards, such as BEP20 on Binance Smart Chain.

For traders, the key point is that these standards are not interchangeable. Confusing standards during transfers or exchange deposits is a practical risk that can lead to lost funds or delayed processing.

ERC20 Tokens and Exchange Infrastructure

From an exchange perspective, ERC20 standardisation simplifies token integration. Because ERC20 tokens follow a predictable structure, exchanges can list and support a large number of tokens with less technical overhead.

For traders, this can mean faster market access and more consistent handling across services. However, traders should still verify deposit networks and token contract details, especially when exchanges support multiple blockchain networks for the same asset name.

ERC20 in Long-Term Trading and Investment Strategies

Beyond short-term trading, ERC20 tokens play a role in longer-term strategies as well.

Many infrastructure projects, decentralised applications and financial protocols issue ERC20 tokens that serve as utility or governance assets. Understanding the token’s mechanics, issuance model and ecosystem role can help traders and investors evaluate risk more realistically.

If stablecoins are part of your trading workflow, it may also be useful to read NordFX’s overview of stablecoin mechanics and risks: Stablecoins in 2025: How They Work, Key Risks, New Rules and Practical Tips for Traders.

Conclusion

ERC20 tokens are a core component of modern cryptocurrency markets. They define how a large share of digital assets are created, transferred and integrated across exchanges, wallets and decentralised platforms.

For traders, understanding ERC20 is not about learning to write smart contracts. It is about improving decision-making, reducing operational risk, and interpreting trading conditions more accurately.

As the crypto market evolves, token standards will continue to shape how trading works in practice. ERC20 remains one of the most important standards every crypto trader should understand.

Go Back Go Back