The Elliott Wave Theory stands as a pivotal tool in technical analysis, exerting a significant impact on trading across financial markets. Numerous traders and analysts employ the principles of this theory to forecast market price movements and identify optimal entry and exit points in trades. Based on this theory, a variety of trading strategies and comprehensive trading systems have been developed, finding successful application in Forex, stock, and cryptocurrency markets. So, what exactly is the Elliott Wave Theory, how did it emerge, and how is it applied?

Who is Mr. Elliott

Ralph Nelson Elliott was born in Kansas, USA, in 1871. While details of his childhood and early education are scant, it is known that he began his career as an accountant. In the mid-1890s, young Ralph entered the accounting field, working primarily with railway companies in Central America and Mexico.

In 1903, Elliott married Mary Elizabeth Fitzpatrick, who accompanied him during his extended work period in Mexico. Civil unrest in the country eventually led the couple back to the USA. Ultimately, the Elliotts settled in New York, where Ralph started a consulting business that proved to be quite successful.

In 1924, Elliott was appointed by the U.S. State Department as the Chief Accountant for Nicaragua, a country then under American control. Soon after, he authored two books based on his professional experience: “Tea Room and Cafeteria Management” and “The Future of Latin America”.

The Genesis of the Elliott Wave Theory

Throughout most of his career, Elliott was engaged in financial accounting and management. His work in this area was grounded in meticulous study and analysis of extensive databases, which later assisted him in his research on the stock market. His interest in the stock market emerged in the early 1930s. After falling ill and stepping back from active professional life, Elliott spent hours and days studying stock quotations and market indices. He analysed and systematized 75 years of market data, including charts with intervals ranging from half-hourly to yearly prices.

Elliott discovered that market price movements were not random and followed certain patterns or "waves". In 1938, in collaboration with Charles J. Collins, he published his third book titled "The Wave Principle", detailing his observations and theories about market behaviour. In this work, Elliott posited that while stock market prices might appear random and unpredictable, they actually follow specific laws and can be measured and forecasted using Fibonacci numbers. He introduced the concept that market prices move in repeating cycles, which he termed "waves". Soon after the publication of "The Wave Principle", the "Financial World" magazine commissioned Elliott to write a series of twelve articles describing his market forecasting method.

It should be noted that Elliott's Wave Theory did not attract much interest during his lifetime. However, throughout the 1940s, he continued refining and promoting his theory, publishing several more articles and books to further develop his ideas. In 1946, Elliott released his final book "Nature's Law – The Secret of the Universe", where he attempted to demonstrate that his Wave Theory was applicable not just to stock markets but also to other areas of life. Ralph Nelson Elliott passed away in 1948. Although his theory continues to be debated and contested, it remains one of the fundamental concepts in technical analysis and continues to influence trading in financial markets to this day.

Fundamental Principles of Wave Theory

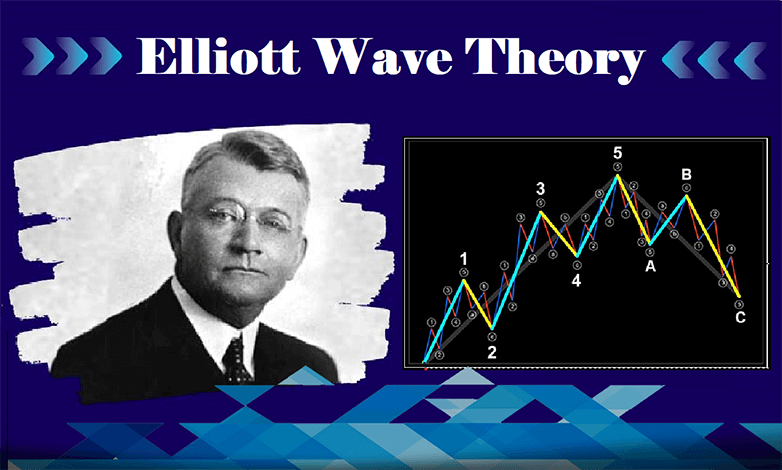

1. Wave Structure: Elliott identified that market prices move in five-wave structures in the direction of the main trend (impulse waves), followed by three-wave structures against the trend (corrective waves).

2. Impulse and Corrective Waves: Within the main trend, impulse waves are labelled with numbers from 1 to 5, while corrective waves are denoted by the letters A, B, and C. Impulse waves drive the market upwards or downwards, whereas corrective waves represent temporary reverse movements.

3. Fractality: The Wave Theory suggests that waves are fractal in nature, meaning each wave can be broken down into smaller waves that follow the same structural pattern.

4. Fibonacci: Elliott discovered that waves often relate to each other in size according to the Fibonacci sequence. For instance, a retracement following a correction often reaches 61.8% of the previous movement.

5. Market Psychology: Wave Theory reflects the mass psychology of market participants. Impulse waves reflect optimism and the desire to invest, while corrective waves reflect uncertainty and the desire to secure profits.

Further Research and Development of Elliott's Theory

Science does not stand still. Over time, many analysts and traders have contributed to the development of Elliott's Wave Theory, adapting its principles to modern market conditions. They have developed various variations and additions to it, including different indicators and algorithms to improve the accuracy of predictions. Let's list some key figures who have made the most notable contributions to this process:

– Robert Prechter: One of the most famous proponents of Wave Theory, he began applying and popularizing it in the 1970s. He wrote several books on the subject, including "Elliott Wave Principle: Key to Market Behaviour," published in 1978 in collaboration with A.J. Frost. Prechter significantly increased awareness of this theory among traders and analysts.

– A.J. Frost: A Canadian analyst who co-authored "Elliott Wave Principle" with Robert Prechter. This book is considered one of the most authoritative works on Wave Theory and has significantly contributed to its popularization and recognition.

– Glenn Neely: Developed Elliott's ideas and formulated "Neely Wave Principles." These principles clarified and supplemented Elliott's original theory, especially in terms of wave structures and time proportions.

– Bill Williams: A trader and author of books on trading psychology, technical analysis, and chaos theory in financial market trading. Williams integrated Wave Theory concepts into his analysis system and developed approaches that help traders identify and trade according to Elliott's wave patterns. Six of the technical indicators created by Williams are included in the standard set of the MetaTrader-4 terminal.

– Peter Brandt: A professional trader with vast experience, often referred to as a "Wall Street Legend." Brandt frequently uses Elliott's theory principles in his trading strategies. In his book "Diary of a Professional Commodity Trader," he discusses, among other things, the application of Wave Theory in practical trading.

– Steve Nison: Better known as an expert on Japanese candlestick charts, he has also made a significant contribution to the popularization of Elliott's Wave Theory, combining it with candlestick analysis for more accurate determination of market entry and exit points.

***

Elliott Wave Theory offers a unique perspective on market behavior. However, it has been repeatedly criticized for its subjectivity and difficulty in application. Mastering it requires a lot of time, effort, and prolonged practice. The main challenges lie in precisely determining the moment when a specific wave begins and ends, as well as in the variability of market conditions, which makes predictions less accurate. Despite this, Elliott's theory remains a key tool for many market participants and is a valuable resource for those seeking to better understand and predict market movements, identify potential price reversals, or continuation of trends. As Robert Prechter said: "Elliott Wave Theory is not just a set of rules and guidelines, it's a new perspective on market behaviour."

Go Back Go Back