The week ending May 23, 2025, witnessed notable movements across major financial instruments. The euro strengthened against the US dollar, gold prices surged, and bitcoin experienced a significant pullback after reaching a new high. These developments set the stage for potential corrections and trend continuations in the upcoming week.

EUR/USD

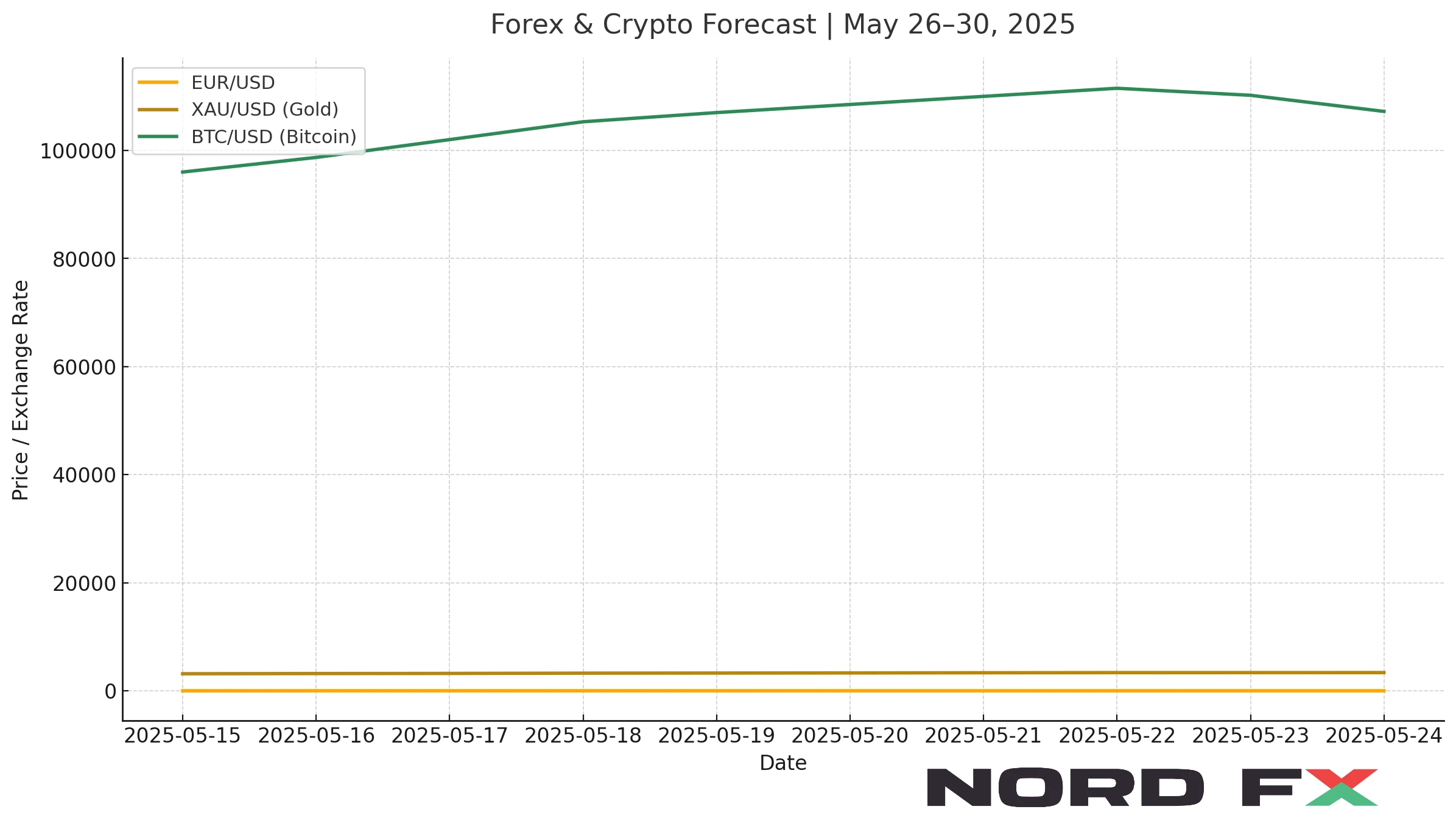

The EUR/USD pair closed the week at 1.1364, marking a 0.77% increase from the previous session. This upward movement suggests a bullish correction within a broader bearish trend. Technical indicators point towards a possible test of the resistance area near 1.1465. However, a failure to break this level could result in a downward bounce, potentially resuming the decline towards the 1.0775 support zone. A decisive break above 1.1825 would invalidate the bearish scenario, indicating a continuation of the upward trend towards 1.2145.

XAU/USD

Gold prices concluded the week at $3,365.30, reflecting a 1.93% gain. The precious metal continues to trade within an ascending channel, supported by bullish momentum. A short-term correction towards the support level near $3,215 is plausible, followed by a potential rebound aiming for the $3,635 resistance area. A drop below $3,045 would challenge the bullish outlook, possibly leading to further declines towards $2,815.

BTC/USD

Bitcoin experienced a notable decline, closing at $107,216.70 on May 24, 2025, down from its all-time high of $111,891.30 reached on May 22. This pullback suggests a bearish correction within the prevailing bullish trend. A test of the support area near $103,405 is anticipated, with a potential rebound targeting levels above $136,505. A breach below $94,605 would invalidate the bullish scenario, indicating a possible decline towards $86,505.

Conclusion

The upcoming week presents opportunities for both trend continuations and corrections across major financial instruments. Traders should monitor key support and resistance levels, as well as technical indicators, to navigate potential market movements effectively.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.