General Outlook

Markets head into the turn of the quarter focused on Wednesday’s euro area CPI flash, Japan’s Tankan survey and Friday’s U.S. jobs report. ISM Manufacturing prints on Wednesday, while ISM Services lands on Friday alongside Non-Farm Payrolls. The dollar recovered into the weekend as U.S. data firmed and sentiment softened, while gold hovered near record territory and bitcoin slipped back below $110k.

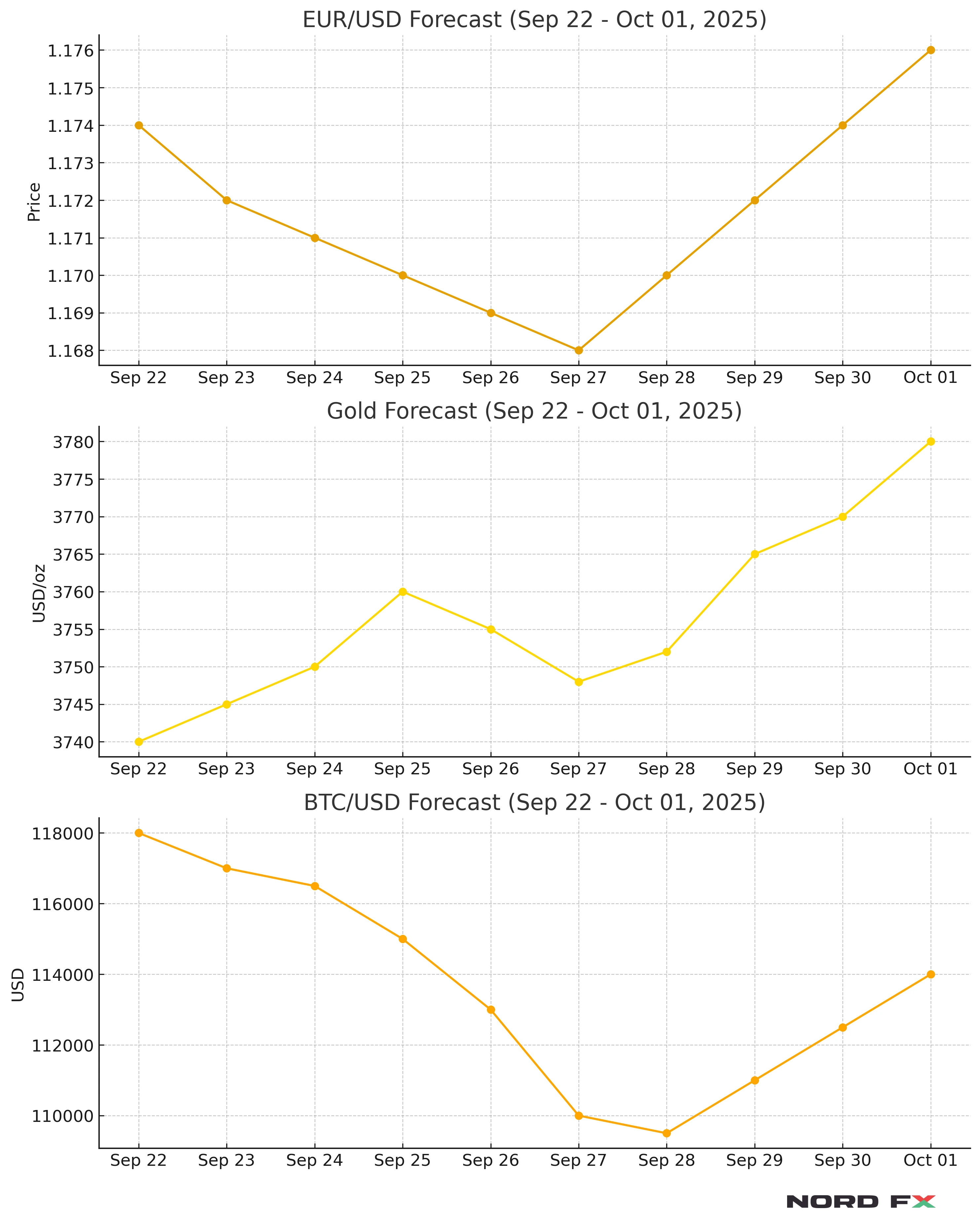

EUR/USD

The pair hovered around 1.17 into Friday and looked set to finish the week lower as the dollar firmed on stronger U.S. data. Eurozone flash PMIs improved to a 16-month high overall but remained uneven across countries, with Germany showing strength and France contracting. This week’s euro area CPI flash (Wed 1 Oct) and U.S. ISM Manufacturing (Wed) are the first tests before Friday’s NFP and ISM Services.

- Resistance: 1.1760–1.1800; then 1.1850–1.1900

- Support: 1.1680–1.1640; then 1.1600

- Trading view: Prefer selling bounces while below 1.1760 with targets toward 1.1680/1.1640; a soft U.S. data run could flip bias back to 1.1800/1.1850 ahead of NFP.

XAU/USD (Gold)

Gold finished the week around $3,740–$3,760, holding near last week’s all-time high (~$3,790.8 on 23 Sept) as real-yield pressure stayed contained and risk appetite wavered. Volumes eased into Friday, but dips remain shallow while policy expectations favour easier settings into Q4. Key catalysts are USD swings around ISM/NFP and any inflation surprise from euro area CPI.

- Resistance: $3,775–$3,791; then $3,820

- Support: $3,705–$3,690; then $3,650–$3,600

- Trading view: Buy-the-dip bias above $3,705 for re-tests of $3,775/$3,791; a strong NFP/ISM Services combo risks a pullback toward $3,650.

BTC/USD

Bitcoin slid below $110,000 late in the week amid weak risk sentiment and options/ETF outflows chatter, retracing from 2025 highs past $120k. The macro calendar (ISM, NFP) and broader liquidity backdrop remain pivotal; a clean reclaim of $117k would stabilise the tape, while sustained closes under $107k risk a run toward $102k.

- Resistance: $114k–$117k; then $120k–$123k

- Support: $107k–$105k; then $102k

- Trading view: Neutral-to-bearish while below $114k–$117k; consider fading rallies unless macro data weaken the dollar materially.

Key Dates

- Tue 30 Sept: China official PMIs (manufacturing & non-manufacturing)

- Tue 30 Sept: U.S. Conference Board Consumer Confidence (Sept); Canada GDP (July actual +0.2% m/m published Fri)

- Wed 01 Oct: Eurozone CPI flash (Sept); U.S. ISM Manufacturing (Sept); Japan Tankan survey (Q3)

- Thu 02 Oct: U.S. weekly jobless claims; U.S. factory orders (Aug)

- Fri 03 Oct: U.S. Non-Farm Payrolls (Sept); U.S. ISM Services (Sept)

Conclusion

For 29 Sept – 03 Oct, EUR/USD starts with a slight downside bias below 1.1700 ahead of euro CPI and U.S. ISMs/NFP; gold stays supported on dips near $3,705–$3,690 while record-high supply/demand dynamics keep buyers engaged; bitcoin needs to reclaim $114k–$117k to avoid deeper pullbacks towards $102k into Friday’s U.S. data volley.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.

Go Back Go Back