In October 2024, the U.S. labor market saw limited movement, with total nonfarm payroll employment rising by only 12,000 jobs, keeping the unemployment rate steady at 4.1%. Health care and government sectors saw continued job growth, while temporary help services and manufacturing experienced declines, the latter impacted by strike activity. Hurricanes Helene and Milton, which caused significant damage and evacuations in the southeastern U.S., may have influenced employment figures and data collection, potentially skewing labor data.

The Bureau of Labor Statistics noted, however, that it cannot quantify the hurricanes' impact on employment shifts. Moreover, the storms did not visibly affect the unemployment rate. After the data release, the dollar fell sharply by 0.35%, while stock indices and cryptocurrencies saw a recovery. Markets are now anticipating rate cuts in 2025, with expectations of a 25 basis point reduction at the November and December Federal Reserve meetings.

The U.S. presidential election on November 5th will be a major focal point for the markets next week, likely driving significant volatility around that date.

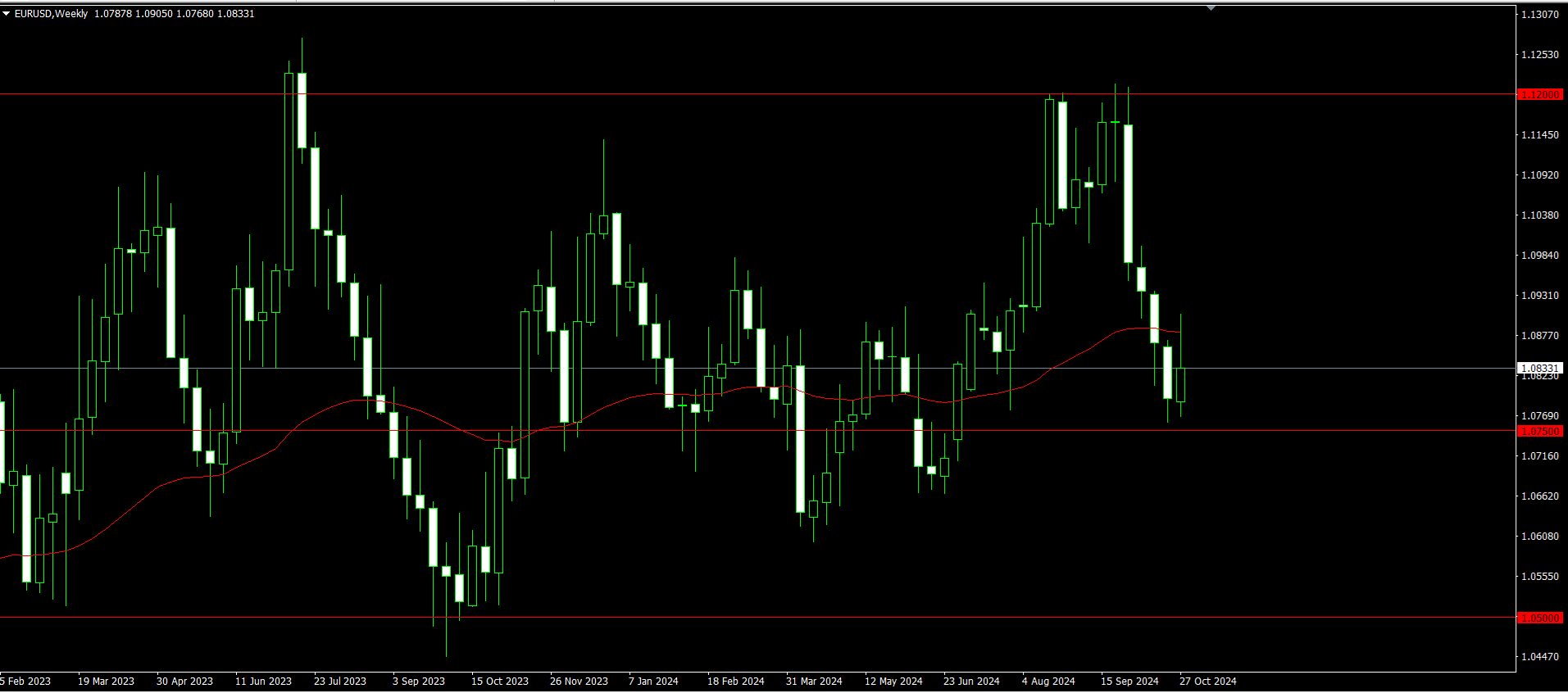

EUR/USD

The Euro saw a slight increase over the week, though it appears to be struggling to hold onto those gains. Currently, the market seems likely to remain volatile and move sideways, with prices hovering around the 50-Week EMA.

If the price breaks above the top of previous week’s candlestick, it could face resistance at the 1.10 level. Conversely, the 1.0750 level offers strong support and is worth monitoring closely. Should the price fall below this point, it may target the 1.05 level, which has consistently served as a major support zone over the past few years. Overall, the market appears to lack clear direction at this stage.

XAU/USD

Escalating geopolitical tensions have led investors to turn to safe-haven assets like gold, fueled by heightened risk aversion and worries about global market stability. Gold has repeatedly set new records this year, climbing over 30% amid expectations of further central bank rate cuts and ongoing geopolitical uncertainties. According to LSEG data, this marks its strongest annual growth since 1979.

Gold had a bullish run past week, but momentum appears to be slowing. The weekly candlestick reflects some hesitation, indicating that a phase of profit-taking might be near. The $2800 mark, a significant psychological level, has drawn substantial market interest. Traders should monitor any pullbacks closely, as these may present buying opportunities, particularly around the $2600 level.

BTC/USD

Bitcoin (BTC) saw a gain of over 2% this week until Friday, with a strong start bringing it close to a new all-time high, followed by a notable decline as signs of profit-taking emerged.

Analysts suggest that Bitcoin might experience a pullback in the coming days ahead of the U.S. presidential election, a critical event that could shape the regulatory landscape for cryptocurrencies. The continuation of Bitcoin’s recent rally in the short term is closely tied to the election results, with many traders believing that a victory for former President Donald Trump could result in more favorable regulatory conditions for the crypto market.

If BTC continues its decline and closes below the $69,500 mark, it could potentially fall over 5% to test the next key support at $66,000, aligning closely with the breakout point of the downward-sloping parallel channel pattern near $65,800 on the weekly chart. However, if Bitcoin stays above $69,500, it may attempt to retest and possibly break through its all-time high of $73,777.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Go Back Go Back