General Outlook

As of Saturday 26 July 2025, the U.S. dollar index has settled just below the 97.45 level and is on track for its biggest weekly decline in a month after closing the prior week around 97.70–97.80. Optimism about U.S. trade deals with the EU and Japan has improved risk sentiment, boosting equities and weakening support for traditional safe‑haven assets such as gold and the dollar. Markets now focus on the Federal Reserve meeting at the end of July and upcoming U.S. macro releases, including GDP and core PCE, for cues on direction heading into the final week of July.

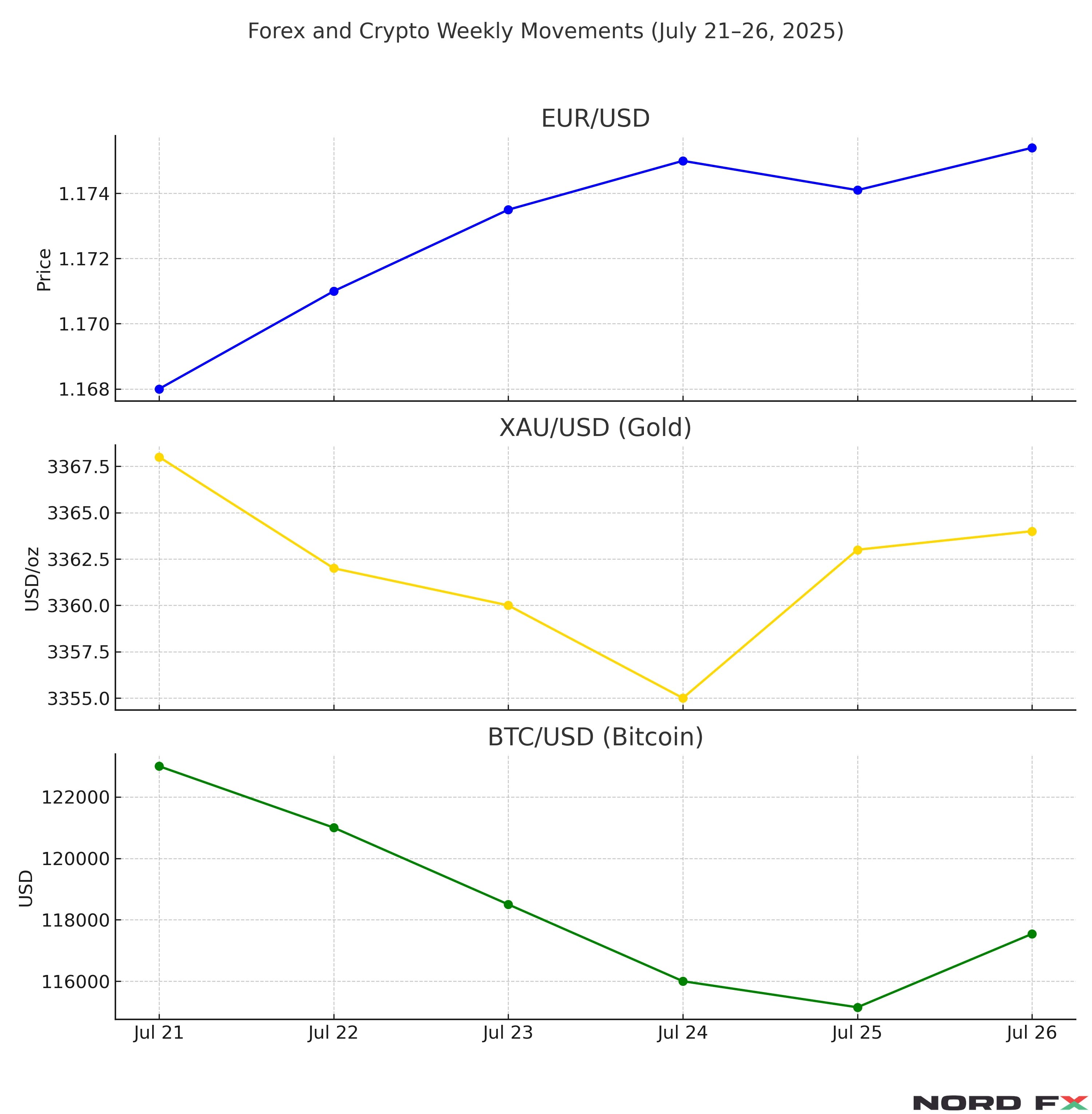

EUR/USD

EUR/USD has traded near 1.1740–1.1750 after bouncing off key support in the 1.1580–1.1720 range in recent weeks. The pair recently tested resistance at 1.1750 and briefly approached 1.1830 earlier in the month; it currently sits close to 1.1754. Support is visible around 1.1710, with secondary support near 1.1660. The pair’s next moves appear tied to the dollar index: a sustained break of 97.80 could weaken the dollar and push EUR/USD higher, while a drop below 97.70 is likely to weigh on the euro.

XAU/USD (Gold)

Gold has consolidated around the $3 360–$3 364 region by Friday 25 July, after falling about 0.1–0.2% during that session. Spot gold closed near $3 363.9 per ounce. A close below the May trend line level of approximately $3 360 would open a path toward support near $3 285. If bullion bulls defend the trend line and push higher, key resistance lies near $3 370 and the imbalance cluster around $3 351.

BTC/USD (Bitcoin)

Bitcoin remains range‑bound around the $117 000–$118 000 area. As of 25 July it traded near $117 540, having dipped below $116 000 on Friday amid a 2.6–2.9% pullback to approximately $115 150. That decline came after breaking from record highs above $123 000 in mid‑July. Momentum suggests risk of further downside toward $115 000 if conditions remain weak, but a reclaim of $118 000 could revive upward pressure. Institutional flows and sentiment shifts remain important drivers.

Conclusion

Looking ahead to the week of July 28–August 1, markets should remain volatile as investors digest the Fed’s decision, key U.S. economic data and any remaining trade‑deal developments ahead of the 1 August tariff deadline. EUR/USD appears tightly ranged and highly sensitive to DXY movement. Gold is vulnerable if it fails to hold the $3 360 trend‑line support. Bitcoin could either stabilise in the current consolidation zone or face additional downside if momentum and flows turn negative. Overall direction will hinge on whether risk appetite endures or falters in the final days of July.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.

Go Back Go Back