The past week saw significant movements in the forex and cryptocurrency markets, with the EUR/USD pair experiencing a correction within a descending channel, gold continuing its bullish trajectory, and bitcoin maintaining its upward trend within a correction phase. Looking ahead to the upcoming week, traders should anticipate further developments in these trends, with key support and resistance levels likely to play a crucial role in shaping market direction. The euro remains under pressure against the dollar, gold may face resistance before a potential pullback, and bitcoin continues to consolidate before a possible breakout.

EUR/USD

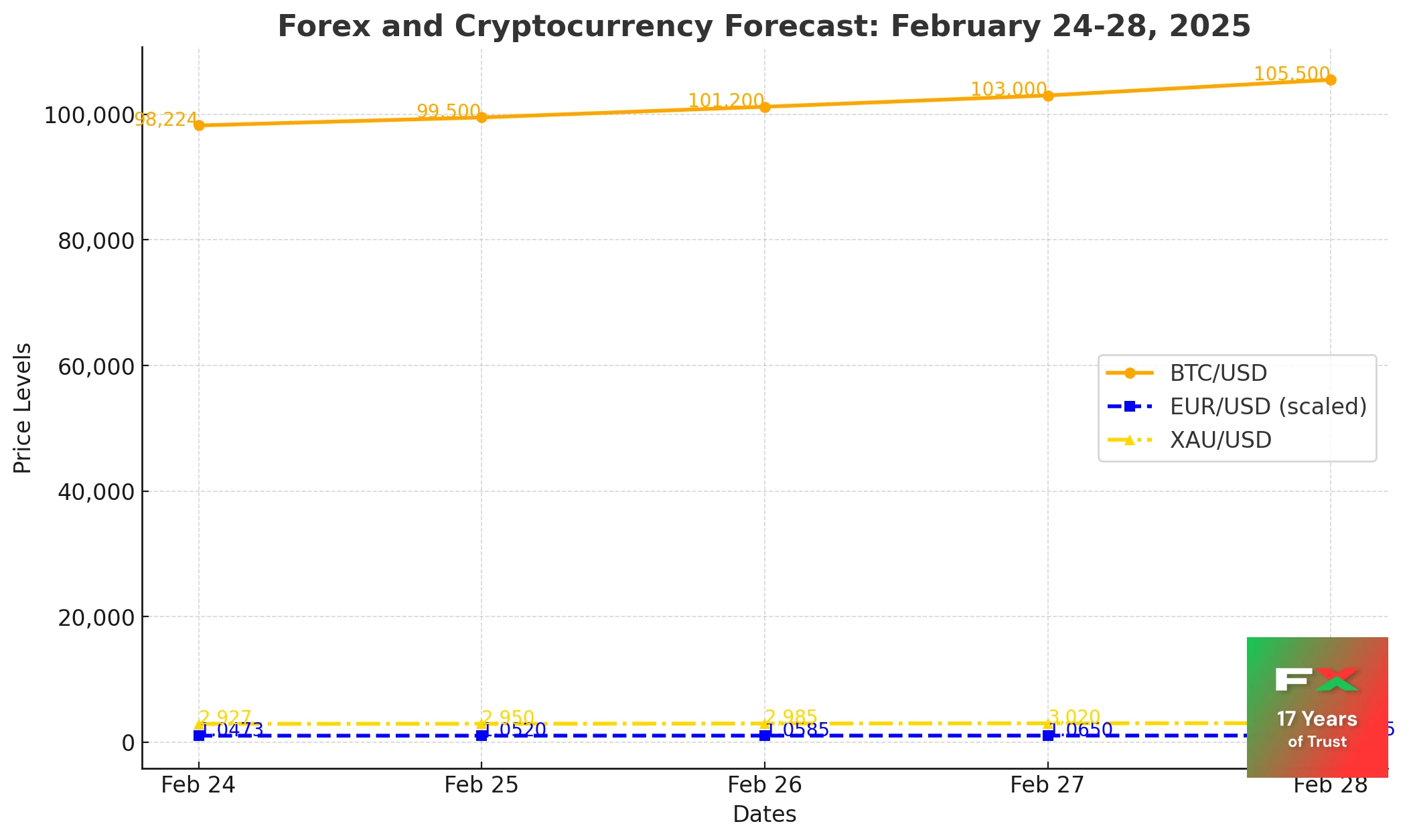

The EUR/USD pair closed the previous trading week near 1.0473, showing signs of recovery but still within a bearish correction. Moving averages indicate a prevailing downward trend, and the pair's recent break below the signal lines suggests sustained selling pressure. The coming week may see an attempt to decline further towards the 1.0085 support level, from where an upward rebound is likely. Should this occur, the euro could advance towards a potential resistance target at 1.0795.

An additional factor supporting a possible recovery is the relative strength index (RSI), which signals a test of the support line. The lower boundary of the descending channel could also act as a point of reversal. However, a decisive break below 0.9875 would invalidate the bullish recovery scenario, suggesting further decline towards 0.9585. Confirmation of continued growth would require a breakout above 1.0645, which would signal an exit from the descending channel and reinforce a bullish outlook for the euro.

XAU/USD

Gold ended the previous week with growth near the 2927 level, continuing to move within a bullish channel. The moving averages indicate a strong upward trend, and the breakout above the signal lines suggests that buyers still dominate the market. In the coming week, gold may attempt to test the resistance level near 2945, followed by a possible downward correction. If the pullback occurs, XAU/USD could decline towards 2735 before a potential rebound.

A further signal supporting a bearish correction is a test of the trend line on the RSI, alongside a rejection from the upper boundary of the bullish channel. However, if gold sees a strong rally past the 3025 resistance level, this could confirm the continuation of the bullish trend, pushing prices towards 3145. Conversely, a confirmed breakout below 2905 would validate the bearish correction and signal further declines.

BTC/USD

Bitcoin closed the trading week at 98,224, continuing to move within a correction phase while maintaining its broader bullish trend. The moving averages suggest an ongoing uptrend, with prices breaking above the signal lines, indicating strong buying interest. In the upcoming week, BTC/USD may attempt to retest support near 94,505 before resuming its upward trajectory. If the rebound occurs, bitcoin could target a resistance level above 130,605.

Technical factors support this scenario, with a potential bounce from the lower boundary of a "Triangle" pattern and a test of the RSI support line. However, a decisive drop below 81,505 would invalidate the bullish outlook, suggesting a further decline towards 75,455. A confirmed breakout above 108,605 would reinforce the bullish trend, signaling a potential breakout from the "Triangle" pattern with an extended target towards the upside.

Conclusion

The upcoming trading week presents key levels to watch across forex and cryptocurrency markets. The EUR/USD pair remains under bearish pressure but could see a recovery if support holds, while gold's bullish trend faces a test at resistance levels. Bitcoin continues its upward correction, with the potential for further gains if it rebounds from support. Traders should monitor price action closely, as breakouts or breakdowns at critical levels will determine the next major moves across these markets.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.