EUR/USD: ECB Triggers Euro Collapse

- The past week was marked by two significant events. The first was the release of Consumer Price Index (CPI) data in the United States on September 13. The second was the meeting of the European Central Bank's (ECB) Governing Council on September 14.

Regarding the first event, the annual CPI in the United States rose from 3.2% in July to 3.7% in August, surpassing market forecasts of 3.6%. On a monthly basis, the CPI increased from 0.2% to 0.6%, precisely in line with market expectations. Financial markets reacted relatively tepidly to this data. According to CME Group, there is a 78.5% likelihood that the Federal Open Market Committee (FOMC) will maintain the key interest rate at its current level of 5.50% per annum during its meeting on September 20. However, the CPI statistics provide the regulator some room for manoeuvre in terms of tightening monetary policy in the future. If inflation in the United States continues to rise, there is a high probability that the Federal Reserve will increase the refinancing rate by another 25 basis points (bps). This is especially likely given that the U.S. economy is demonstrating stable growth and the national labor market remains robust. The published number of initial unemployment claims was 220K, which was lower than the forecasted 225K.

The second event triggered a considerably more volatile response. On Thursday, September 14, the ECB raised its key interest rate for the euro by 25 basis points (bps) for the tenth consecutive time, moving it from 4.25% to 4.50%. This is the highest it has reached since 2001. Experts had varying opinions on the move, labelling it as either hawkish or dovish. However, in theory, an interest rate increase should have supported the common European currency. Contrarily, EUR/USD fell below the 1.0700 mark, recording a local low at 1.0631. The last time it reached such depths was in the spring of 2023.

The decline in the euro was attributed to dovish comments made by the ECB's leadership. One could deduce from these that the central bank had already brought rates to levels that, if sustained over an extended period, should bring inflation within the Eurozone down to the target 2.0%. ECB President Christine Lagarde's statement, "I'm not saying we are at the peak of rates," failed to impress investors. They concluded that the current hike to 4.50% is likely the last step in this tightening cycle of monetary policy. As a result, with the backdrop that the Federal Reserve may still raise its rate to 5.75%, bears in EUR/USD have gained a noticeable advantage.

Bearish momentum increased even further following Thursday's release of data indicating that U.S. retail sales for August increased by 0.6% month-over-month (MoM), significantly exceeding the 0.2% forecast. At the same time, the Producer Price Index (PPI) for August rose by 0.7%, also surpassing expectations and the previous reading of 0.4%.

"We anticipate that the relative strength of the U.S. economy will continue to put pressure on EUR/USD in the coming months, as the growth differential will play a leading role. We maintain our forecast for the cross to be at the 1.0600-1.0300 range over the next 6-12 months," comment strategists at Danske Bank, one of Northern Europe's leading banks. They continue: "Given that it's hard to envision a sharp shift in the current U.S. dollar dynamics, and with commodity prices currently rising, we may reach our 6-month forecast for the cross earlier than expected."

HSBC strategists predict an even faster decline for the pair, anticipating that it will reach the 1.0200 level by the end of this year. According to specialists at ING, the pair could drop to the 1.0600-1.0650 area around the time of the Federal Reserve meeting in the upcoming week. "We believe that, at this stage, the EUR/USD rate will be increasingly influenced by the dollar," they write. "Markets have recognized that the ECB has most likely reached its peak interest rate, which means that Eurozone data should become less relevant. We might see EUR/USD rise again today [September 15], but a return to the 1.0600/1.0650 area around the date of the Federal Reserve meeting seems highly likely.".

As of the time of writing this review, on the evening of Friday, September 15, the pair indeed rose and ended the five-day trading period at the 1.0660 mark. 55% of experts are in favour of a continued upward correction, while 45% agree with ING economists' opinion and voted for a decline in the pair. As for technical analysis, almost nothing has changed over the past week. Among the trend indicators and oscillators on the D1 timeframe, 100% are still favouring the U.S. currency and are coloured in red. However, 25% of the latest indicators signal that the pair is oversold. Immediate support for the pair is located in the 1.0620-1.0630 area, followed by 1.0515-1.0525, 1.0480, 1.0370, and 1.0255. Bulls will encounter resistance in the 1.0680-1.0700 zone, then at 1.0745-1.0770, 1.0800, 1.0865, 1.0895-1.0925, 1.0985, and 1.1045.

The upcoming week will be quite eventful. On Tuesday, September 19, consumer inflation data (CPI) for the Eurozone will be released. Undoubtedly, the most significant day of the week, and perhaps even the upcoming months, will be Wednesday, September 20, when the FOMC meeting of the Federal Reserve will take place. In addition to the interest rate decision, investors expect to glean valuable information from the FOMC's long-term forecasts as well as during the press conference led by the Federal Reserve's management. On Thursday, September 21, the traditional initial jobless claims data will be published in the United States, along with the Federal Reserve Bank of Philadelphia's Manufacturing Activity Index. Friday promises a deluge of business activity statistics, with the release of PMI data for Germany, the Eurozone, and the United States.

GBP/USD: Awaiting the Bank of England Meeting

- According to recent statistics, the UK economy is going through a challenging period. Some of the more emotional analysts even describe its condition as dire. GBP/USD continued to decline against the backdrop of disappointing GDP data for the country. According to the latest figures released by the Office for National Statistics (ONS) on Wednesday, September 13, the British economy contracted by -0.5% on a monthly basis, compared to an expected decline of -0.2%.

The day before, on Tuesday, the ONS published equally disheartening data concerning the labor market. The unemployment rate for the three months through July rose to 4.3%, compared to the previous figure of 4.2%. Employment decreased by 207,000 jobs, while the economy lost 66,000 jobs a month earlier. The market consensus forecast had been for a reduction of 185,000 jobs.

The Bank of England's (BoE) efforts to combat inflation appear to be rather modest. Although the annual rate of price growth in the UK has decreased from 7.9% to 6.8% (the lowest since February 2022), inflation remains the highest among the G7 countries. Moreover, the core Consumer Price Index (CPI) remained unchanged from the previous month at 6.9% year-on-year, only 0.2% below the peak set two months earlier.

Sarah Briden, the Deputy Governor of the BoE, believes that the "risks to inflation [...] are currently to the upside," and that it will only reach the target level of 2% two years from now. Meanwhile, according to quarterly survey data, only 21% of the country's population is satisfied with what the Bank of England is doing to control price growth. This marks a new record low.

Analysts at Canada's Scotiabank believe that the decline of GBP/USD could continue to 1.2100 in the coming weeks, and further to 1.2000. Economists at the French bank Societe Generale hold a similar view. According to them, while a fall to 1.1500 seems unlikely, the pair could very well reach 1.2000.

GBP/USD concluded the past week at a mark of 1.2382. The median forecast suggests that 50% of analysts expect the pair to correct upwards, 35% anticipate further movement downwards, and the remaining 15% point eastward. On the D1 chart, 100% of trend indicators and oscillators are coloured red, with 15% indicating that the pair is in oversold territory. If the pair continues to move south, it will encounter support levels and zones at 1.2300-1.2330, 1.2270, 1.2190-1.2210, 1.2085, 1.1960, and 1.1800. In the event of an upward correction, the pair will face resistance at 1.2440-1.2450, 1.2510, 1.2550-1.2575, 1.2600-1.2615, 1.2690-1.2710, 1.2760, and 1.2800-1.2815.

Among the key events related to the UK economy, the publication of the Consumer Price Index (CPI) on Wednesday, September 20, stands out. This inflation indicator will undoubtedly impact the Bank of England's decision on interest rates (forecasted to rise by 25 bps, from 5.25% to 5.50%). The BoE meeting will take place on Thursday, September 21. Additionally, toward the end of the workweek, data on retail sales and the UK's Purchasing Managers' Index (PMI) will be released.

USD/JPY: No Surprises Expected from the Bank of Japan Yet

- Since the beginning of this year, the yen has been gradually losing ground to the U.S. dollar, with USD/JPY returning to November 2022 levels. It's worth noting that it was a year ago at these heights that the Bank of Japan (BoJ) initiated active currency interventions. This year, however, the BoJ has so far engaged only in verbal interventions, although quite actively: high-ranking Japanese officials are frequently making public comments.

In a recent interview with Yomiuri newspaper, BoJ Governor Kazuo Ueda stated that the central bank might abandon its negative interest rate policy if it concludes that sustainable inflation targets of 2% have been achieved. According to Ueda, by year-end, the regulator will have sufficient data to assess whether conditions are ripe for a policy shift.

This verbal intervention had an impact: markets responded with a strengthening of the yen. However, the "magic" was short-lived, and USD/JPY soon resumed its upward trajectory, closing the five-day trading period at 147.84.

Economists at Danske Bank believe that the global environment favours the Japanese yen and forecast a decline in USD/JPY to 130.00 over a 6-12 month horizon. "We believe that yields in the U.S. are peaking or close to it, which is the primary argument for our bearish stance on USD/JPY," they state. "Additionally, under current global economic conditions, where growth and inflation rates are declining, history suggests that these are favourable conditions for the Japanese yen." Danske Bank also anticipates that a recession could begin in the United States within the next two quarters, prompting the Federal Reserve to cut dollar interest rates. Until the Federal Reserve concludes its easing cycle, the Bank of Japan is expected to maintain its monetary policy unchanged. Therefore, any action from the BoJ before the second half of 2024 is unlikely.

As for short-term forecasts, Societe Generale does not rule out the possibility that following the FOMC decision by the Federal Reserve on September 20, USD/JPY could move closer to the 150.00 mark. As for the Bank of Japan's meeting on Friday, September 22, no surprises are expected, and it will likely involve another round of verbal intervention. Meanwhile, the vast majority of surveyed experts (80%) believe that if the Federal Reserve rate remains unchanged, USD/JPY has a high likelihood of correcting downward. Only 10% expect the pair to continue its upward trajectory, while another 10% take a neutral stance. All trend indicators and oscillators on the D1 time frame are coloured green, although 10% of these are signalling overbought conditions.

The nearest support levels are located in the 146.85-147.00 zone, followed by 145.90-146.10, 145.30, 144.50, 143.75-144.05, 142.90-143.05, 142.20, 141.40-141.75, 140.60-140.75, 138.95-139.05, and 137.25-137.50. The nearest resistance is at 147.95-148.00, followed by 148.45, 148.85-149.10, 150.00, and finally, the October 2022 high of 151.90.

We have already mentioned the Bank of Japan's meeting on September 22. No significant economic data concerning the state of the Japanese economy is scheduled for release in the coming week. Traders should be aware, however, that Monday, September 18, is a public holiday in Japan as the country observes Respect for the Aged Day.

CRYPTOCURRENCIES: Death Cross and Bitcoin Paradoxes

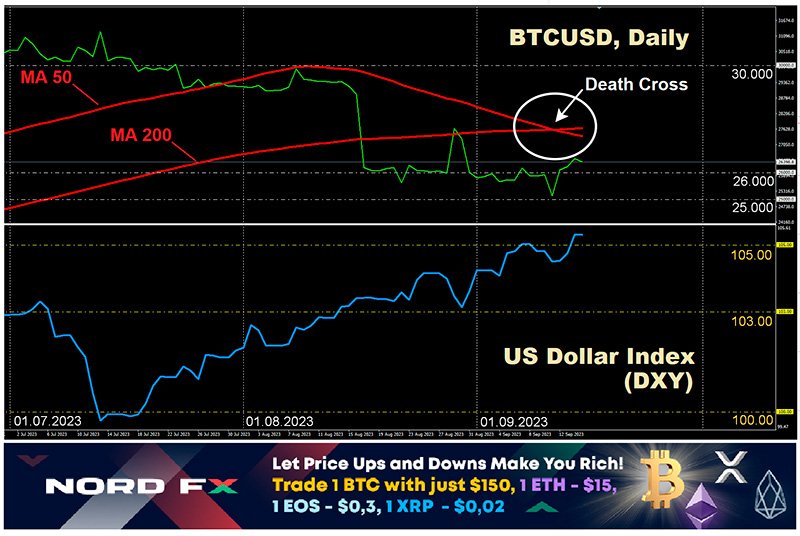

- A "Death Cross," indicated by the intersection of the 50-day and 200-day moving averages, has appeared on bitcoin's daily chart. This pattern last emerged in mid-January 2022, and was followed by a nearly threefold decrease in bitcoin's price by November, which is cause for concern. Interestingly, a similar Death Cross was observed in July 2021, but did not result in a price decline, offering some reassurance.

The current week in the cryptocurrency market has been marked by high volatility, with trading volumes for the leading cryptocurrency reaching $15 billion. Such levels of activity are typically only seen around major macroeconomic events. In this case, they include the release of U.S. inflation data on Wednesday, September 13, and the upcoming Federal Reserve meeting on September 20.

The BTC/USD weekly chart showed the following trends. On Monday, September 11, the price of bitcoin fell below $25,000, despite a weakening dollar and rising stock indices. This decline was fueled by rumors that the controversial FTX exchange was planning to sell digital assets as part of a bankruptcy proceeding. On Tuesday, investors resumed buying at lower levels, pushing the coin's price above $26,500. On Thursday, following the ECB's decision on interest rates, bitcoin continued to strengthen its position, reaching a high of $26,838. This occurred even as the dollar was strengthening.

In fact, the recent price dynamics are quite paradoxical. Imagine BTC/USD as a set of scales. When one side becomes heavier, it goes down while the other goes up. Yet, we witnessed both sides simultaneously descending and ascending. According to some analysts, there was no fundamental rationale behind these bitcoin movements. With low liquidity and falling market capitalization, the asset was merely being "shifted" from one group of speculators to another.

Even the testimony of Gary Gensler, the Chairman of the U.S. Securities and Exchange Commission (SEC), before the U.S. Senate did not spook market participants. He stated that the overwhelming majority of cryptocurrencies fall under the jurisdiction of his agency. Consequently, all intermediaries in the market, exchanges, brokers, dealers, and clearing agencies, are required to register with the SEC.

Gensler compared the current state of the crypto industry to the "wild west" years of the early 20th century, when securities market legislation was still being developed. During those years, the agency took a series of strict enforcement actions to rein in the industry, and many cases ended up in court. Similar measures are needed today, not only to serve as a deterrent to businesses but also to protect investors, the SEC Chairman stated. (It's worth noting that, according to Ripple CEO Brad Garlinghouse, the SEC is to blame for the U.S. becoming one of the "worst places" to launch cryptocurrency projects.)

But aside from the SEC, there are other regulators, such as the Federal Reserve. It's clear that the Fed's decisions and forecasts, which will be announced on September 20, will impact the dynamics of risky assets, including cryptocurrencies. Mike McGlone, Senior Macro Strategist at Bloomberg Intelligence, has already warned investors that the near future for the crypto sector looks challenging. According to him, digital assets gained popularity during a period of near-zero interest rates. However, as monetary policy shifts, challenges could arise for the industry. McGlone pointed out that the yield on U.S. Treasury bonds is expected to reach 5.45% by November, based on futures contracts. In contrast, from 2011 to 2021, this yield was only about 0.6% annually, a period during which bitcoin and other digital assets saw significant growth. Therefore, a liquidity outflow from cryptocurrencies would not be surprising.

Once again, many analysts are offering positive medium- and long-term forecasts but negative short-term outlooks. Michael Van De Poppe, founder of venture firm Eight, predicts a final price correction for the leading cryptocurrency before an impending bull rally. According to him, if bears manage to breach the exponential moving average line, currently at $24,689, the coin could drop to as low as $23,000 in a worst-case scenario. Van De Poppe believes this upcoming correction represents the last chance to buy bitcoin at a low price.

Dan Gambardello, founder of Crypto Capital Venture, predicts that the next bull cycle could be the most impressive in the cryptocurrency market. However, he also reminds investors that the crypto market follows cycles and appears to be in an accumulation phase. Given this, Gambardello warns that there's a possibility that bitcoin's price could drop to $21,000 in the coming weeks. He attributes this potential decline to market manipulation by major players who may be driving down prices to accumulate coins in anticipation of the next bull run.

According to a popular expert known as CrypNuevo, the flagship cryptocurrency could soon reach a $27,000 mark. However, the analyst emphasized that this is likely to be a false move, and a dip down to around $24,000 should be expected thereafter. (It's worth noting that on August 17, the BTC price broke through the ascending trend line that started in December 2022 and settled below it, indicating a high risk of a prolonged bearish trend.)

As for the short-term prospects of the leading altcoin, they also appear to be less than optimistic. Analysts at Matrixport have warned that if ETH drops to $1,500, the path to $1,000 would be open: a level the experts consider justifiable based on their revenue projections for the Ethereum blockchain ecosystem. Matrixport notes that ETH is not a "super sound money" capable of resisting inflation, as the number of coins minted last week exceeded the amount burned by 4,000. This represents a deviation from the deflationary model that the blockchain adopted with the consensus algorithm transition from Proof of Work (PoW) to Proof of Stake (PoS).

Analyst Benjamin Cowen sets an even lower target. He claims that Ethereum is on the brink of "extreme volatility," potentially plummeting to a range between $800 and $400 by the end of the year. The reason remains the same: a possible decline in the profitability of blockchain platforms built on ETH smart contract technologies. According to Cowen, both ETH bulls and bears "have crashed and failed to execute their strategies," which will result in both parties locking in their losses by the end of 2023.

With three and a half months remaining until the end of the year, the current state of the market at the time of writing this review, Friday evening, September 15, shows ETH/USD trading around $1,620 and BTC/USD at $26,415. The total market capitalization of the crypto market stands at $1.052 trillion, up from $1.043 trillion a week ago. The leading cryptocurrency accounts for 48.34% of the market, while the primary altcoin makes up 18.84%. The Crypto Fear & Greed Index for bitcoin remains in the 'Fear' zone at 45 points, albeit inching closer to the 'Neutral' zone (it was 46 points a week ago).

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Go Back Go Back