EUR/USD: Just a Calm Week

- The last week was quite calm for the EUR/USD pair. It moved along the Pivot Point 1.0500, and the maximum range of fluctuations was less than 140 points (1.0468-1.0605), which is quite small for today.

President Joe Biden's appeal to the US Congress, with the exception of a proposal to introduce a tax holiday on fuel for 3 months, was, in fact, about nothing. And the federal tax on gasoline is only 18 cents per gallon, which is less than 4%. So, in such a short period of time, this measure will not have any effect on the economy, much less tame inflation.

As for the Fed, its head Jerome Powell, speaking in Congress, did not say anything new either. He only confirmed that, despite the threat of a recession, his organization will continue to fight inflation by tightening monetary policy. These intentions were also confirmed by Powell's colleague Michelle Bowman, a member of the Fed's Board of Governors, who stated that raising the key rate by 0.75% in July and by at least 0.50% at the next few meetings of the FOMC (Federal Open Market Committee) is not only appropriate, but also necessary.

There were no surprises in the words of both officials, and the markets, apparently, have already included this increase in their quotes for a long time. However, the yield on 10-year US bonds corrected against this backdrop to the lowest level in the last two weeks, falling from 3.5% to 3%. Stock Markets (S&P500, Dow Jones and Nasdaq), as well as other risky assets, on the contrary, grew slightly. This was facilitated by the absence of any significant events on the Ukrainian-Russian front and the associated decline in prices for natural energy resources. So, for example, the cost of oil has decreased by about 10-13% over the past 10 days.

The macro statistics released on Thursday, June 23, although caused an increase in volatility initially, eventually returned the EUR/USD pair to the equilibrium point like a swing. The reason is that business activity in both the EU and the US turned out to be noticeably worse than expected. In the Eurozone, the index of business activity in the manufacturing sector, according to the forecast, should have decreased from 54.6 to 54.0, but actually fell to 52.0 points. The index of business activity in the services sector has similar indicators: it fell from 56.1 to 52.8 instead of the expected 55.8 points. Thus, the composite index Markit lost 2.9 points instead of 0.6, falling from 54.8 to 51.9 (forecast 54.2).

Following the European one, the similar American statistics came out, which turned out to be no less disappointing. Thus, the index of business activity in the manufacturing sector fell by as much as 4.6 points to 52.4 (previous value 57.0, forecast 56.0). A similar indicator in the service sector turned out to be slightly better: a drop from 53.4 to 51.6 points (forecast 53.0). As a result, the composite index of business activity decreased from 53.6 to 51.2 points, instead of the forecasted 52.8 points.

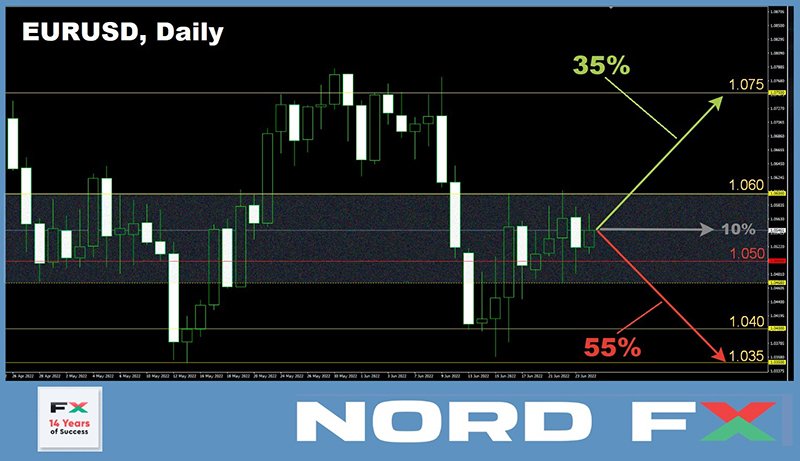

EUR/USD ended the trading session at 1.0555. At the time of writing the review, on the evening of June 24, the votes of experts are divided as follows: 35% side with the bulls, 55% - with the bears, and 10% cannot decide on the forecast. The readings of the indicators on D1 look quite chaotic. Among the oscillators, 35% are colored red, 25% are green and 40% are neutral gray. Among the trend indicators, 60% are red and 40% are green. The nearest strong resistance is located in the 1.0600 zone, if successful, the bulls will try to break through the 1.0640 resistance and rise to the 1.0750-1.0770 zone, the next target is 1.0800. Apart from 1.0500, the number 1 task for the bears is to break through the support around 1.0470, and then update the May 13 low at 1.0350. If successful, they will move on to storm the 2017 low of 1.0340, there is only support from 20 years ago below.

As for the upcoming week, data on the US consumer market will be released on Monday June 27, the German consumer market data on June 29 and 30, and Eurozone consumer prices (CPI) on Friday July 01. The value of the US Manufacturing PMI will be published on July 01 as well. In addition, it is worth paying attention to the data on US GDP (Q1), which will become known on June 29. In addition, a whole series of speeches by the head of the ECB, Christine Lagarde, is scheduled for the week: she will speak on June 27, 28 and 29. There will also be a performance by her overseas colleague Jerome Powell, but only one, on Wednesday, June 29.

GBP/USD: Looking for Drivers

- Having started the five-day period at 1.2216, the GBP/USD pair ends it at 1.2280. And if in the period from June 13 to June 17, the maximum range of fluctuations exceeded 470 points, it was 3 times less last week, keeping within just 160 points. This lull was caused largely by the absence of high-profile macroeconomic events. However, it also suggests that the market cannot decide what to do with the pound, and is looking for drivers that can move the pair in one direction or another.

According to some analysts, the strengthening of the British currency is hindered by political instability. Prime Minister Boris Johnson already survived a vote of no confidence in June, with several lawmakers from his own Conservative Party voting against him. In addition, after the by-elections, the party lost two seats in the UK Parliament.

In terms of the national economy, retail sales fell 0.5% m/m in May according to the Office for National Statistics. This turned out to be slightly better than market expectations, which predicted a decline of 0.7%. But it did not help the British currency much, as the annual figure reached 9.1%, updating the 40-year high. The main contribution to the growth of inflation was made by the increase in prices for fuel and food products.

According to some experts, inflation in the United Kingdom will continue to grow and may exceed 11% by November. It is clear that this causes discontent among the population, as it reduces the level of income, depreciates savings, and also undermines the current purchasing power. To combat this evil, the Bank of England (BOE) raised its key rate from 1.00% to 1.25% on June 16. As a result, the British currency gained 365 points in just a few hours. But can the regulator, just like the US Federal Reserve, not be afraid of the economy slipping into recession and continue to regularly increase the cost of borrowing? Many traders and investors doubt this.

At the moment, 40% of experts believe that the GBP/USD pair will try to test the resistance of 1.2400 again in the near future, 25%, on the contrary, are waiting for a support test in the 1.2170-1.2200 area, the remaining 35% of analysts have taken a neutral position.

Among the trend indicators on D1, the balance of power is 75-25% in favor of the reds. There is no such clear advantage among oscillators: only 45% are pointing to a fall, 25% are looking in the opposite direction, and the remaining 30% are looking east. Supports are located at levels 1.2170-1.2200, then 1.2075 and 1.2040. The pair's strong foothold lies at the psychologically important 1.2000 level, followed by the June 14 low at 1.1932. In case of growth, the pair will meet resistance in the zones and at the levels of 1.2300-1.2325, 1.2400-1.2430, 1.2460, then the targets in the area of 1.2500 and 1.2600 follow.

As for the macroeconomic events of the coming week regarding the United Kingdom, we can highlight the publication of data on the country's GDP for the Q1 2022 on Thursday, June 30. The speech of the Governor of the Bank of England Andrew Bailey, which will take place the day before, on Wednesday, June 29, may also be of interest. And the business activity index (PMI) in the UK manufacturing sector will be published at the very end of the working week, on Friday, July 01.

USD/JPY: "Head" and "Shoulders" Are Visible. What's next?

- The USD/JPY formed a classic technical analysis head and shoulders pattern over the past week. Starting from 134.95, it rose to the height of 136.70, then rolled back to the local low of 134.25, and finished at 135.20.

The divergence between the monetary policies of the Bank of Japan and the US Federal Reserve helped to update the 24-year high once again, having risen to 136.70 on Wednesday, June 22. We have already written about this many times. As for the subsequent rollback down, the reason is most likely the June decline in world prices for mineral fuels, on which the country's economy is highly dependent, as well as the fall in the yield of 10-year US Treasuries.

It is common knowledge that there is a direct correlation between 10-year US Treasury bills and the USD/JPY currency pair. And if the yield of these securities falls, the yen shows growth against the dollar, and the USD/JPY pair forms a downtrend. This is what we observed in the second half of the week, when the yield on government bonds fell to 3%.

Reuters reported that Japan's annual core consumer inflation in May exceeded the central bank's target of 2% in May for the second consecutive month. Which is a signal of increasing pressure on the fragile Japanese economy due to rising world prices for raw materials.

A number of experts believe that the forecast of the Bank of Japan (BOJ) about the temporary nature of price growth is incorrect. Hence, the “super-dove” monetary policy of the regulator is wrong. Rising fuel and food prices driven by Russia's invasion of Ukraine and a weak yen that pushes up the cost of imports could keep inflation above the Bank of Japan's target for much of 2022, these analysts said.

Japanese officials do not deny this problem. Thus, the Government and the Bank of Japan issued a joint statement on June 17 stating that they are concerned about the sharp fall in the national currency. Seiji Kihara, Deputy Chief Cabinet Secretary of Japan, also said that the impact of inflation on consumer sentiment will be closely monitored. However, according to Masayoshi Amamiya, Deputy Governor of the Japanese Central Bank, the country's economy is gaining momentum, so the BOJ will continue to adhere to a relaxed monetary credit policy.

Considering the above, the general fundamental background remains on the side of the USD/JPY bulls, and its current decline can be regarded as a correction from the previous multi-year highs, which was caused by lower fuel prices and a drop in Treasury yields.

Most analysts (50%) expect the correction to continue at least to the level of 133.00-133.50. 30% of experts have voted for the fact that the pair will once again try to renew the high and rise above 137.00, and 20% believe that the pair will take a breather, moving in a sideways trend. For indicators on D1, the picture is very different from the opinion of experts. 85% of the oscillators are colored green (of which 10% are in the overbought zone), the remaining 15% have taken a neutral position. For trend indicators, 85% point north and only 15% look south. The nearest support is located at 134.40, followed by zones and levels at 134.00, 133.50, 133.00, 132.30, 131.50, 129.70-130.30, 128.60 and 128.00. Apart from breaking the immediate resistance at 135.40 and the June 22 high at 136.70, further targets for the bulls are difficult to determine. Most often, such round levels as 137.00, 140.00 and 150.00 appear in the forecasts. And if the pair's growth rates remain the same as in the last 3 months, it will be able to reach the 150.00 zone in late August or early September.

As for the calendar for the coming week, we can mark Friday, July 01, when Tankan (Q2) sentiment indexes of large manufacturers and large non-manufacturing companies in Japan will be published.

CRYPTOCURRENCIES: BTC Forecast from the President of El Salvador

- We called the last review "Bloodbath or $20,000 Battle". As for the past week, there was not much blood this time, but the battle for $20,000, as predicted, did not subside. The week's low was fixed at $17,597, the maximum at $21,667, and the BTC/USD pair met Saturday, June 25, at $21,350. At this point, the total crypto market capitalization was $0.960 trillion ($0.895 trillion a week ago). The Crypto Fear & Greed Index is still not going to leave the Extreme Fear zone and is at around 11 points out of 100 possible (7 points a week ago).

The general mood of the market is fully consistent with this Extreme Fear. The Internet is talking again about the death of bitcoin. According to Google Trends, the number of search queries on this topic has returned to its maximum levels, close to December 2017. Recall that at that moment, approaching the coveted $20,000, the main cryptocurrency turned around and flew down, losing more than 40% of its value in a few days. The only difference with that long-standing situation is that bitcoin was approaching the $20,000 level from below then, and it is from above now. And the market was looking for a top then, and for a bottom now. Moreover, according to a number of influencers, it is not at all necessary that the bottom is at this particular mark.

So, according to Peter Schiff, Euro Pacific Capital President, a well-known cryptocurrency critic, “so far, there are no signs of surrender, which usually forms the bottom of the bearish market”. According to this gold supporter, the $20,000 mark will be the same “bull trap” as the $30,000 level was before. “Nothing falls in a straight line. It's actually a very ordered crash in slow motion," Schiff said. Recall that he predicted back in May that bitcoin would test $8,000. And he suggested in mid-June that the minimum could be even lower, around $5,000.

According to the president of Euro Pacific Capital, the collapse of the cryptocurrency market will be good for the economy. Kevin O'Leary, co-host of the business TV show Shark Tank, made a similar point. He believes that one should not be afraid of the bankruptcy of large companies during the crypto winter. “This is good for all other companies as they will learn from this. I think we will soon see a wave of bankruptcies in the cryptocurrency market. I don't know who it will be. Later you will recognize those who have taken a high-risk position. But I assure you I have seen this before. They have been destroyed, and that's good,” said the millionaire.

The InvestAnswers crypto channel, in turn, named 3 possible catalysts for a further market collapse. The BTC price may fall even more if MicroStrategy CEO Michael Saylor decides to sell the bitcoins in the company's reserves. In addition, the potential collapse of the stablecoin Tether (USDT) and the problems of the cryptocurrency hedge fund Three Arrows Capital may also contribute to further capitulation of BTC. According to InvestAnswers, we should not forget about the possible sale of crypto assets by Tesla.

MicroStrategy reported a $1.2 billion loss last week due to the fall of bitcoin. As for the Three Arrows Capital fund, it now has about $2.4 billion left in assets out of $18 billion.

Big problems are experienced not only by investors, but also by miners. Due to the fall in the price of BTC and the increase in computational complexity, the total return from mining is now 65% lower than the average for the year. At the same time, the efficiency of the Antminer S19 ASIC from Bitmain is 80% worse than the level of November 2021, and the popular S9 model has lost profitability altogether. This situation has led to the fact that mining companies are forced to sell their BTC holdings in order to pay off loans and cover current operating costs, which puts pressure on the market. Their remaining reserves are estimated at 46,000 coins (about $920 million). In the event that these bitcoins are also thrown into sale, quotes will certainly fall further down.

An analyst aka Capo, who had correctly predicted the collapse of the cryptocurrency market this year, updated his forecast. In his opinion, BTC expects a decline to $16,200, and ETH to $750. According to Capo, investors are fooling themselves into believing that a short-term rally means bitcoin is bottoming the cycle: “Bull trap. Funds from altcoins flow into BTC, which will also be sold, but a little later. There is no bottom yet,” he said.

According to another specialist, crypto strategist Kevin Svenson, bitcoin has a chance to bottom in the $17,000-18,000 range, after which a short-term rally to above $30,000 may occur. At the same time, although Svenson expects this short-term growth, he does not see the prerequisites for launching a new bull market in the near future: “Overcoming the main downward resistance is the main obstacle and the process may last until the end of the year.” According to the strategist, after the breakthrough of the diagonal resistance, bitcoin can trade in a narrow range for several months and start a new uptrend only by 2024 year.

Despite the low current rate of bitcoin, many participants in the crypto industry believe in its future growth. For example, there is a belief that BTC could reach $100,000 by 2025. One of those who supported such optimism was an analyst called PlanB, who built his forecasts based on the Stock-to-Flow (S2F) model. This model worked well for three years until March 2022, after which it failed.

The Daily Gwei creator Anthony Sassano and Ethereum co-founder Vitalik Buterin have recently criticized S2F, advising PlanB to delete their account.

The analyst reacted to criticism with restraint. He said that in the aftermath of the crash, many are looking for scapegoats, including leaders. PlanB then presented a graph of five different BTC price prediction models. According to the illustration, the most accurate picture is given by estimates based on the complexity and cost of mining the first cryptocurrency. The S2F model, in turn, offers an overly optimistic view.

Another expert, Benjamin Cowen, proposed his bitcoin bottoming model. He believes that the bottom can be predicted based on the correlation of inflation, the S&P 500 stock index and the BTC price. The analyst argues that the S&P 500 index does not historically sink to the very bottom until inflation peaks and reverses. Accordingly, BTC cannot reach the bottom for the same reason. “Macroeconomic indicators look incredibly bleak at the moment. If you go back to the 1970s, you'll see a very similar type of move where the S&P bottomed just as inflation hit its first peak. By this point, the S&P was down about 50%,” writes Cowen.

And to conclude the review, one more “prediction model”, which we put in our humorous crypto life hacks section. It was presented by the President of El Salvador, Nayib Bukele. “My advice is to stop looking at charts and enjoy your life. If you have invested in BTC, your investment is safe, its value will rise immeasurably after the end of the bear market. The main thing is patience,” he wrote. For reference, there are 2,301 BTC in El Salvador's public bitcoin fund, purchased at an average price of $43,900. Thus, at the moment, the loss on them is about 55%. But, according to the "model" of Nayiba Bukele, this "trifle" should not be paid attention to. The main thing is to get the most out of life!

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Go Back Go Back