Microsoft Corporation (NASDAQ: MSFT) has long been a dominant force in the technology sector, consistently driving innovation across cloud computing, artificial intelligence (AI), enterprise software, and gaming. As of February 2025, Microsoft’s stock is priced at $410.92, following a decade of impressive growth fueled by its Azure cloud services, AI integration, and strategic acquisitions. With a market capitalization exceeding $3 trillion, Microsoft is one of the most influential companies in the global financial markets.

For traders, long-term stock price predictions are crucial in identifying profitable investment opportunities. The Microsoft stock price prediction for 2030 is a widely discussed topic, as analysts and investors seek insights into how the company’s rapid advancements in AI, cloud technology, and enterprise solutions will shape its future valuation.

Several factors will influence MSFT’s future stock price, including:

- Artificial intelligence and its impact on Microsoft’s core products and services

- Expansion of Azure and competition with Amazon Web Services (AWS)

- The growth of Microsoft’s gaming division, especially after the Activision Blizzard acquisition

- Macroeconomic trends, interest rates, and regulatory challenges

This article provides a detailed analysis of Microsoft’s past performance, expert forecasts for 2025 to 2030, and key market trends that traders should watch when considering long-term investment or trading opportunities in MSFT stock.

Microsoft Stock Price Performance: A Historical Overview

Microsoft Corporation (NASDAQ: MSFT) has demonstrated remarkable growth since its initial public offering (IPO), evolving into one of the most valuable companies in the world. Understanding the stock’s historical performance provides valuable insights into how it may behave in the future.

IPO and Early Growth

Microsoft went public on March 13, 1986, at an IPO price of $21 per share. Adjusted for stock splits, this translates to just $0.0601 per share in today’s terms. Throughout the late 1980s and early 1990s, Microsoft’s stock steadily climbed as the company became the leader in personal computing software. The release of Windows 95 in 1995 and its subsequent updates propelled the company’s growth, pushing its stock price higher.

Dot-com Boom and Crash

During the late 1990s, Microsoft, like many tech companies, saw its stock price soar due to the internet boom. By December 1999, MSFT reached an all-time high of around $58 (adjusted for splits). However, the dot-com bubble burst in early 2000, causing tech stocks to plummet. Microsoft’s stock fell sharply, reaching a low of approximately $13.47 by the end of 2000. Despite the downturn, the company remained profitable and continued its dominance in the software market.

2008 Financial Crisis and Recovery

The global financial crisis of 2008 further impacted Microsoft’s stock, dropping it from around $29 in late 2007 to approximately $15 in early 2009. However, Microsoft’s strategic shift toward cloud computing played a crucial role in its recovery. The launch of Azure in 2010 marked the beginning of a new era for the company, shifting its business model from software licensing to subscription-based services and cloud infrastructure.

%20Stock%20Price%20History.webp)

2010s to 2023: AI, Cloud, and Market Expansion

Under the leadership of CEO Satya Nadella, who took over in 2014, Microsoft aggressively expanded its cloud business. Azure quickly became one of the leading cloud service providers, competing with Amazon Web Services (AWS). The stock price reflected this success, climbing from around $31 in 2013 to over $185 by early 2020.

The COVID-19 pandemic accelerated digital transformation, further boosting demand for cloud services, enterprise software, and AI-powered solutions. By late 2021, Microsoft’s stock price reached an all-time high of $349.67 before experiencing fluctuations due to interest rate hikes and macroeconomic concerns. The launch of OpenAI’s ChatGPT in late 2022, along with Microsoft’s partnership with OpenAI, triggered another surge in its valuation, reinforcing its leadership in AI development.

Current Status: 2024-2025

As of February 2025, Microsoft’s stock price stands at $410.92, reflecting a 10.5% growth over the past year. The company’s market capitalization has surpassed $3 trillion, driven by strong financials, expansion in AI, and continued cloud adoption. While fluctuations are expected, Microsoft remains a key player in the technology sector with a solid long-term outlook.

For traders looking to analyze Microsoft’s past trends and forecast its future, historical performance offers critical insights into its resilience and growth potential. According to MacroTrends, Microsoft’s long-term trajectory suggests continued gains, with AI and cloud services acting as primary growth drivers.

Key Factors Influencing Microsoft Stock Price in 2030

Several key drivers will determine Microsoft’s stock performance over the next decade. As the company continues to expand its presence in artificial intelligence, cloud computing, and gaming, these areas will play a crucial role in shaping its future valuation.

Artificial Intelligence (AI) Growth

Microsoft’s heavy investment in AI is expected to be a major factor driving its stock price in the coming years. The company's partnership with OpenAI has already led to the integration of AI-powered tools like Copilot across its suite of products, including Office 365, Bing, LinkedIn, and Dynamics 365.

The rise of AI-driven automation and productivity tools is transforming business operations, making Microsoft’s AI solutions more valuable to enterprises. Azure’s AI-enhanced cloud services are also gaining traction, helping businesses deploy AI at scale. Analysts estimate that AI-driven solutions could contribute over $100 billion in revenue for Microsoft by 2030, reinforcing its leadership position in the sector.

Cloud Computing Dominance (Azure vs. AWS)

Cloud computing remains one of Microsoft’s most critical revenue streams. Azure, which accounted for approximately 30 percent of Microsoft's total revenue in 2024, grew by 31 percent year-over-year. As businesses continue their shift to cloud-based infrastructure, demand for Azure’s services is expected to increase significantly.

Competition with Amazon Web Services (AWS) and Google Cloud will shape Microsoft’s future growth in this segment. While AWS has maintained the largest market share, Azure has steadily gained ground due to its AI-driven cloud services and enterprise solutions. Projections indicate that Microsoft’s cloud revenue could exceed $500 billion by 2030, making it a cornerstone of the company’s financial success.

Gaming and Metaverse Expansion

Microsoft's gaming division, bolstered by its acquisition of Activision Blizzard, is another key factor influencing its stock price. The deal strengthens Microsoft's position in the gaming industry, particularly through its Xbox Game Pass and cloud gaming initiatives.

AI-driven gaming innovation, including personalized experiences and AI-powered non-playable characters (NPCs), is expected to enhance user engagement. With the gaming industry projected to grow substantially over the next decade, Microsoft could see an additional 15 to 20 percent increase in gaming-related revenue by 2030. The integration of AI in gaming and the potential expansion into the metaverse could further solidify Microsoft’s dominance in this space.

Microsoft’s Strong Financials and Dividend Payouts

Microsoft has maintained strong financial health over the years, regularly distributing dividends to investors. This makes its stock attractive for long-term holders who seek steady returns. The company’s diversified revenue streams across software, cloud, AI, and gaming provide stability, even during periods of market uncertainty.

Analysts project Microsoft’s total revenue to reach between $700 billion and $800 billion by 2030. The combination of AI advancements, cloud expansion, and gaming growth will likely contribute to this financial strength, further reinforcing investor confidence in the stock.

Market Volatility and Economic Risks

Despite Microsoft’s strong growth prospects, the company is not immune to external economic factors. Global market conditions, interest rate fluctuations, and regulatory scrutiny could impact its stock price trajectory. Governments worldwide are increasing regulations on AI and technology companies, which could pose challenges to Microsoft’s AI expansion.

Additionally, cybersecurity threats remain a concern as businesses and consumers become increasingly reliant on cloud-based solutions. Microsoft must continue investing in security measures to maintain its reputation and avoid potential financial or reputational setbacks.

While competition from other tech giants remains a key challenge, Microsoft’s ability to innovate and adapt will play a decisive role in its stock performance. Traders and investors should closely monitor these factors when considering Microsoft’s long-term potential in the stock market.

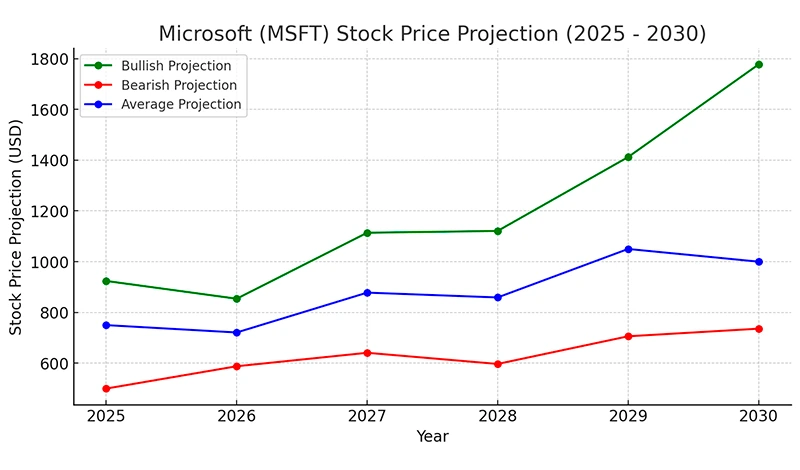

Microsoft Stock Price Prediction 2025-2030

Forecasting the future price of Microsoft (MSFT) stock requires analyzing key market trends, company performance, and economic conditions. As Microsoft continues to expand in artificial intelligence, cloud computing, and gaming, its stock is expected to show strong growth potential. However, uncertainties such as regulatory challenges, market volatility, and competition from other tech giants could influence its trajectory.

Microsoft Stock Prediction for 2025

Analysts predict that Microsoft’s stock will trade in the range of $500 to $924 in 2025.

- Bullish Case: If AI and cloud expansion continue at their current pace, Microsoft’s stock could surge toward the $900+ range. Strong enterprise adoption of AI-powered tools and increasing revenue from Azure and AI services would drive investor confidence. Additionally, Microsoft's gaming division, bolstered by its acquisition of Activision Blizzard, could contribute significantly to earnings.

- Bearish Case: A global economic slowdown, increasing interest rates, or regulatory hurdles in the AI sector could limit Microsoft’s stock growth. If market conditions deteriorate, MSFT could face a pullback toward $500 by the end of 2025.

While there is strong potential for continued gains, 2025 is likely to be a transition year, where Microsoft solidifies its AI leadership and strengthens its cloud computing dominance.

Microsoft Stock Prediction for 2026-2029

Microsoft's stock is expected to maintain an upward trend over the next several years, largely driven by advancements in AI, cloud services, and enterprise software. Below is a year-by-year forecast for MSFT stock:

| Year | Bullish Projection | Bearish Projection |

| 2026 | $854 | $588 |

| 2027 | $1,114 | $641 |

| 2028 | $1,121 | $597 |

| 2029 | $1,412 | $706 |

- 2026: Microsoft is projected to reach between $588 and $854, depending on cloud market expansion and AI adoption. Regulatory pressures in AI could influence short-term stock performance.

- 2027: With AI becoming a fundamental part of global business operations, Microsoft’s AI and enterprise cloud services could push its stock toward $1,114 in a bullish scenario. If competition from AWS and Google Cloud increases, the price may stay around $641.

- 2028: As Microsoft's cloud and AI integration across industries matures, its stock could remain above $1,100, but potential shifts in government regulations and cybersecurity risks might cap gains.

- 2029: The most bullish scenario places Microsoft’s stock at $1,412, with an increasing revenue share from AI services, gaming, and cloud infrastructure. A more conservative estimate sees the stock at $706 if economic headwinds slow growth.

Microsoft Stock Prediction for 2030

By 2030, Microsoft’s stock price is expected to reach new highs, driven by long-term innovations and strategic investments. Analysts provide the following projections:

| Projection Type | MSFT Price Target |

| Most Bullish | $1,777 |

| Most Bearish | $736 |

| Average Forecast | $850 - $1,000 |

- Bullish Case: If Microsoft maintains strong dominance in AI and cloud computing, its stock price could climb to $1,777. The continued expansion of its enterprise AI solutions, Azure cloud services, and gaming portfolio would drive long-term profitability.

- Bearish Case: If AI regulations become restrictive, or if competitors gain an edge in cloud computing and enterprise solutions, Microsoft’s stock might trade closer to $736.

- Average Scenario: Most analysts agree that MSFT stock is likely to stabilize between $850 and $1,000, assuming steady growth across its key business segments.

The key uncertainties for Microsoft's stock in 2030 revolve around regulatory policies, global economic conditions, and competitive pressures from major tech rivals. However, with its strong market position and continued investments in AI and cloud computing, Microsoft remains one of the most promising long-term investments in the technology sector.

Should You Invest in Microsoft Stock?

Investing in Microsoft stock presents both opportunities and risks. As one of the world’s largest technology companies, Microsoft has a strong track record of innovation, financial stability, and market leadership. However, traders must weigh the potential upside against possible challenges.

Pros of Investing in Microsoft Stock

- AI and cloud computing are key growth drivers, with Microsoft at the forefront of AI innovation through its partnership with OpenAI and its integration of AI across Azure, Office 365, and other enterprise products.

- Microsoft dominates the enterprise software market, with a near-monopoly on office productivity tools and strong adoption of cloud-based business solutions.

- The company has a solid history of paying dividends, making it attractive to long-term investors seeking steady returns.

Cons of Investing in Microsoft Stock

- Microsoft stock is already highly valued, meaning potential upside could be limited compared to smaller, high-growth companies.

- Market volatility, interest rate changes, and economic downturns could impact short-term stock performance.

- Increasing regulations on AI and technology companies could introduce challenges, particularly in global markets where governments are tightening control over digital services.

Trading Strategies for MSFT Investors

- Long-Term Hold: Investors targeting 2030 and beyond could benefit from Microsoft’s steady growth, AI advancements, and expanding cloud dominance. Holding the stock long-term allows investors to take advantage of compounding returns and dividend payouts.

- Swing Trading: Traders can capitalize on short-term price movements triggered by AI product launches, earnings reports, and macroeconomic shifts. Microsoft’s stock often experiences volatility around major announcements, providing opportunities for swing traders.

- CFD Trading: For those looking to profit from price fluctuations without owning the stock, contract-for-difference (CFD) trading offers an alternative. This approach allows traders to go long or short based on market trends, making it a flexible strategy for active traders.

Microsoft remains a strong long-term investment, but traders should stay informed about market conditions, regulatory developments, and the company’s ongoing AI and cloud initiatives.

Conclusion

Microsoft’s stock price prediction for 2030 suggests an optimistic outlook, with projections ranging between $850 and $1,777. The company’s success in AI, cloud computing, and enterprise software positions it for sustained growth, making it a compelling stock for traders and investors alike.

While uncertainties such as economic downturns, regulatory challenges, and competition could impact Microsoft’s trajectory, its strong market presence and diversified revenue streams provide a solid foundation for continued expansion.

For long-term investors, Microsoft remains one of the most promising stocks in the tech sector. Traders, on the other hand, can take advantage of its price fluctuations through various strategies, including swing trading and CFD trading.

As the technology landscape evolves, Microsoft’s leadership in AI and cloud computing will be crucial in determining its future valuation. Whether you’re a long-term investor or a short-term trader, MSFT stock remains a strong contender for those looking to capitalize on the future of technology.

FAQ

1. What is the Microsoft stock price prediction for 2025?

Analysts predict that Microsoft’s stock could trade between $500 and $924 by the end of 2025. The bullish case is driven by AI and cloud computing expansion, while the bearish case considers global market uncertainty and regulatory risks.

2. Will Microsoft stock reach $1,000 by 2030?

Many analysts believe that Microsoft (MSFT) stock has the potential to surpass $1,000 by 2030, especially if AI and cloud services continue their strong growth. The most bullish forecasts place the stock as high as $1,777, while more conservative estimates suggest a range of $850 to $1,000.

3. What factors will influence Microsoft's stock price in the next decade?

Key factors include artificial intelligence growth, cloud computing dominance, gaming expansion, financial performance, and regulatory challenges. AI-powered solutions and Azure’s cloud business are expected to drive Microsoft’s revenue, while competition and market volatility could impact stock performance.

4. Is Microsoft stock a good long-term investment?

Microsoft remains a strong long-term investment due to its leadership in AI, cloud computing, and enterprise solutions. The company also has a solid financial position, pays dividends, and continues to expand into high-growth sectors like AI-driven automation and cloud security.

5. What are the best trading strategies for Microsoft stock?

- Long-term investing: Holding MSFT stock until 2030+ for potential high returns.

- Swing trading: Taking advantage of short-term price fluctuations from AI and cloud announcements.

- CFD trading: Profiting from Microsoft’s price movements without owning the stock, allowing for both long and short positions.

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.

Quay lại Quay lại