EUR/USD: The Pair Is at a Crossroads

- We wondered at the beginning of the last review if the dollar rally had come to an end. Let us recall that the US inflation data published on November 10 turned out to be significantly better than both previous values and forecasts. Core consumer inflation (CPI) rose by 0.3% in October, which was lower than both the forecast of 0.5% and the previous September value of 0.6%. The annual growth rate of core inflation slowed down as well to 6.3% (against the forecast of 6.5%, and 6.6% a month ago).

This pace of change in CPI was the slowest in the last 9 months, confirming that a series of sharp interest rate hikes has finally had the desired effect. Market participants have immediately decided that the Fed is now likely to slow down the pace of tightening its monetary policy (QT). As a result, the DXY Dollar Index went into a steep peak, losing 2.1%, which was a record drop since December 2015. The American currency weakened against the euro as well: EUR/USD rose from 0.9935 to 1.0363 in two days, from November 10 to 11, breaking through the parity level.

The pair continued to grow at the beginning of last week: it fixed a local maximum at 1.0480 on Tuesday, November 15, but then went down sharply to 1.0279, and ended the five-day period in the 1.3210 zone.

The main reasons for this behavior are the ambiguous macro statistics from the US, the hawkish forecasts of the Fed leaders and the vague statements by the head of the ECB. Let's start in order, with statistics. Data on the US Producer Price Index (PPI) showed a reduction in inflationary pressure: the growth slowed down from 8.4% to 8.0%. US construction volumes rose to 1.425 million new homes in October, which was higher than expected. But at the same time, the September figure had been revised up to 1.488 million homes. As a result, the dynamics turned out to be negative. Statistics on building permits issued in October was also above the forecast of 1.526 against 1.512 million houses, but lower than the previous month, 1.564 million. The manufacturing activity index of the Federal Reserve Bank of Philadelphia generally fell sharply to -19.4 points against -8.7 points in September, although the forecast for October was -6.2.

Things are quite multidirectional in Europe as well. Thus, the ZEW Economic Sentiment Index in Germany turned out to be significantly better than both the forecast and the previous value (-36.7/-50.0/-59.2). But the Consumer Price Index (CPI) in the Eurozone pointed to an increase in inflation from 9.9% to 10.6%.

The second factor that determined the dynamics of the dollar was the statements by the leaders of the US Federal Reserve. Thus, if the Fed's chief hawk, the head of the Federal Reserve Bank (FRB) of St. Louis James Bullard, had earlier predicted a peak in the key interest rate in the range of 4.75-5.00%, he has now raised the bar by another 25 basis points to 5.00 - 5.25%. San Francisco Federal Reserve Bank President Mary Daley shares a similar opinion, pointing to the target range of 4.75-5.25%. Atlanta Fed chief Rafael Bostic also said that monetary tightening and interest rate hikes would continue.

Note that, according to the CME Group FedWatch Tool, the probability that the Fed will raise the base rate by 50 bps in December is 85%, while the probability of a rise by 75 bps is only 15%. Such assessments of the market can be considered quite neutral, since the American Central Bank is still ahead of its counterparts from other G10 countries in terms of monetary policy tightening. Thus, speaking at the Financial Conference in Frankfurt (Germany) this week, the head of the European regulator Christine Lagarde said that the ECB certainly “expects a further increase in rates to the levels necessary to ensure that inflation returns to the medium-term target of 2%.” But at the same time, she did not outline any specific steps. Moreover, Madame Lagarde emphasized that "it is necessary that the normalization of the balance occurs in a measured and predictable way." After such words, investors experienced a certain disappointment, which did not allow EUR/USD to continue its growth.

According to strategists at ING, the largest banking group in the Netherlands, the pair will fall again below the 1.0000 parity line in the medium term. "If the Fed remains a key driver for the dollar, the ECB will continue to play a fairly minor role for the euro, which instead remains largely pegged to global risk sentiment and geopolitical/energy dynamics." At the same time, ING does not rule out a new mini rally for the pair in the short term.

Only 15% of analysts expect the pair to rise even higher to the north in the near future, 55% expect a turn to the south. The remaining 30% of experts point to the east. The picture is different among the oscillators on D1. All 100% of the oscillators are colored green, while 15% are in the overbought zone. Among the trend indicators, the advantage is also on the side of the greens: 75% advise buying the pair, 25% selling. The immediate support for EUR/USD is at 1.0270, followed by the levels and zones at 1.0254, 1.0130, 1.0070, 0.9950-1.0010, 0.9885, 0.9825, 0.9750, 0.9700, 0.9645, 0.9580, and finally the Sep 28 low at 0.9535. The next target of the bears is 0.9500. Bulls will meet resistance at levels 1.0390-1.0400, 1.0422-1.0438, 1.0480, 1.0620, 1.0750, 1.0865, 1.0935.

The calendar includes Wednesday, November 23, among the events of the upcoming week. A lot of macroeconomic statistics on the US economy will be released on this day. This includes data on unemployment, the state of the housing market, and the volume of orders for capital goods and durable goods. In addition, the minutes of the last meeting of the FOMC (Federal Open Market Committee) of the US Federal Reserve will be published. Information on business activity in Germany and the Eurozone as a whole will be received on the same day. The United States has a holiday on Thursday, November 24, and an early closing of trading on Friday, November 25: the country celebrates Thanksgiving. But the value of the IFO Business Climate Index and the volume of German GDP will become known on the same days.

GBP/USD: Gloomy Forecasts for the Pound

- As in the case of the euro, GBP/USD rose not because of the gains in the pound, but because of the weakening of the dollar, caused by the latest US inflation data. As for the British currency, the fundamental background of the United Kingdom gives signals about the deterioration of the economic situation in the country over and over again. Thus, according to data published last week, the unemployment rate increased from 3.5% to 3.6%. The average salary level increased from 5.5% to 5.7%. Inflation, such as the annual Consumer Price Index (CPI), rose in the UK in October to its highest level since 1982 and reached 11.1% (with a forecast of 10.7% and the September value of 10.1%). Retail sales (y/y) fell by -6.1% in October against the forecast -6.5% and the previous result -6.8%. It seems that the fall has slowed down here, but it is still a very strong fall.

UK Chancellor of the Exchequer Jeremy Hunt presented a new plan from the government of new Prime Minister Rishi Sunak on Thursday November 17, according to which budget spending should be reduced by up to 60 billion pounds. Given that this plan also included tax increases, GBP/USD could go down sharply again. However, as ING analysts commented sarcastically, "the pound has survived the long-awaited autumn announcement by the Treasury Secretary." The impact of tax increases on the economy may not be huge and should only affect high incomes and the energy industry. However, ING believes that it is still too early to talk about stabilization and believes as before that downside risks remain for the pair, as the dollar may start to recover towards the end of the year. As a result, the target for GBP/USD will be below 1.1500.

While ING thinks that the pound has survived Jeremy Hunt's speech in the short term, the economic situation in the UK still looks rather bleak in the long term according to experts from Commerzbank. The head of the Ministry of Finance turned out to be much more pessimistic than the average opinion of analysts. He believes that the country's economy is already in recession and expects a 1.4% decline in GDP (analysts' median forecast is -0.5%).

Of course, rising inflationary pressures in the UK could lead to more aggressive rate hikes by the Bank of England (BoE). However, according to many experts, the regulator will still avoid drastic steps, since excessive tightening of monetary policy can generally knock out the economy for a long two years. According to forecasts, the UK's current account deficit will remain at more than 5% of GDP in 2023-24. The result may be a resumption of the downward trend of the British currency

The last chord of the week for GBP/USD sounded around 1.1880. The median forecast for the near future looks rather mixed: 40% of experts side with the bulls, 25% side with the bears, and the remaining 35% prefer to remain neutral.

Among the oscillators on D1, 100% are on the green side, of which, as in the case of the previous pair, 15% give overbought signals. As for the trend indicators, the ratio is 85% to 15% in favor of the green ones. The levels and support zones for the pair are 1.1800-1.1840, 1.1700-1.1715, 1.1600, 1.1475-1.1500, 1.1350, 1.1230, 1.1150, 1.1100, 1.1060, 1.0985-1.1000, 1.0750, 1.0500 and the September 26 low of 1.0350. When the pair moves north, the pair is for resistance at the levels of 1.1960, 1.2045-1.2085, 1.2135, 1.2210, 1.2290-1.2330, 1.2425 and 1.2575-1.2610.

Statistics on the United Kingdom economy include the publication of the S&P Global Business Activity Index in the country's manufacturing sector on Wednesday, November 23. The values of a whole group of business activity indices will become known a day later, on Thursday, November 24: in the services sector, in the manufacturing sector and the UK composite PMI.

USD/JPY: What Awaits the Yen after April 08?

- Well, what can we say about this pair? Actually, nothing new. “Uncertainty about the Japanese economy is extremely high,” said Haruhiko Kuroda, Governor of the Bank of Japan (BoJ), speaking to the country's Parliament. And he added that his organization "will continue to ease monetary policy to support the economy and achieve a target inflation rate of 2% on a sustainable, stable basis, backed by wage growth."

The Japanese Central bank governor's comments come amid reports that the country's consumer inflation rate has hit a 40-year high. And, according to many experts, BoJ's super-pigeon position will not change until April 08, 2023. It is on this day that Haruhiko Kuroda's powers in this post will end, where he can be replaced by a new candidate with a less dovish position. Before that, in Q1of the new year, an important factor determining the future monetary policy of the Central Bank will be the growth of wages in the country, which can lead to a revolutionary reversal of USD/JPY down to the south. After that, according to the forecasts of a number of experts, it may end 2023 near the level of 130.00.

As for closer prospects, the forecast of specialists from the French financial conglomerate Societe Generale will be interesting here. “USD/JPY has experienced a deep pullback after breaking below chart levels at 145.00. A break of 137.80 could extend the downtrend,” they write. “An initial rebound is not ruled out, but 143.50 and the lower end of the previous range at 145 are likely to be short-term resistance levels. Holding below 143.50 risks another leg of decline. The break of 137.80 could see further downside to 200-DMA near 134 and 132.50.”

The pair ended the last trading session in the 140.35 zone. The fact that the dollar will try to win back at least part of the losses in the near future, and USD/JPY will turn to the north, is expected by 40% of analysts. 15% vote for a breakthrough to the south and a new fall. The remaining 45% have found it difficult to make a forecast. For oscillators on D1, the picture looks like this: 100% are looking south, 10% of them are in the oversold zone. Among the trend indicators, the ratio is 85% to 15% in favor of the red ones. The nearest strong support level is located in the zone 138.85-139.05, followed by the levels 138.45, 137.50, 135.55, 134.55 and the zone 131.35-131.75. Levels and resistance zones are142.20, 143.75, 145.30, 146.85-147.00, 148.45, 149.45, 150.00 and 151.55. The purpose of the bulls is to rise and gain a foothold above the height of 152.00. Then there are the 1990 highs around 158.00.

No important events regarding the state of the Japanese economy are expected this week. It should also be borne in mind that Wednesday, November 23 is a holiday in the country, Labor Day.

CRYPTOCURRENCIES: Is There Life after Bankruptcy?

- The bankruptcy of the FTX exchange remains the most discussed event. But if the main topic was the event itself last week, the focus of the discussion has now shifted to the question of what will happen to the crypto industry as a whole. Will it be able to avoid collapse and recover from its wounds? And what can be done to prevent similar upheavals in the future?

The FTX incident has shown that the cryptocurrency industry needs “very careful regulation.” This opinion was expressed by US Treasury Secretary Janet Yellen, and she added that the consequences of the collapse of the Sam Bankman-Freed empire could be even worse if the cryptocurrency market had been more closely intertwined with the traditional financial system.

The head of the Ministry of Finance was supported by experts from the investment bank JPMorgan, who consider current events a positive catalyst. They stated that the FTX crisis would benefit the industry and help it move a few steps forward. The collapse of one of the largest crypto companies will push regulators to accelerate the process of forming regulatory rules that allow effective control of the sector. And the introduction of a comprehensive regulatory framework will facilitate the institutional acceptance of cryptocurrencies.

Jordan Belfort, a former stockbroker who served time in prison for securities fraud and known as the “Wolf of Wall Street”, has also sided with law enforcement. He believes that the potential of bitcoin will be realized when the crypto sector becomes fully regulated. And this “Wolf” called the current market downturn “cleansing”.

As a result of this “cleansing” and a prolonged decline in the crypto market, according to the Bank for International Settlements, approximately three-quarters of bitcoin investors lost money. And according to a study by the analytical agency Crypto Fund Research, losses of cryptocurrency funds can reach up to $5 billion. According to experts, the crisis affected 25-40% of industry investment structures that invested in FTX or its utility token FTT. Joshua Gnaizda, CEO of Crypto Fund Research, clarified that we are talking about 7-12% of assets under fund management.

Paradigm and Sequoia Capital reported that their potential losses due to the FTX crisis could be $278 million and $213 million, respectively. About $175 million has been blocked at the Genesis Trading brokerage company. As of November 8, Mike Novogratz's Galaxy Digital investment firm had $76.8 million in FTX-related positions. Multicoin Capital invested $25 million in the US division of FTX, and also held $2 million in USDC on the exchange itself. Investments in FTX US through the Venture Fund II, created in July, amounted to $430 million. Crypto Fund Research experts have estimated the value of Pantera Capital's FTX-related assets at approximately $100 million.

Industry participants admitted on condition of anonymity that the losses of asset managers could be even greater. “The number of funds absolutely destroyed by this bankruptcy is just beginning to be revealed,” one of the sources said. Researchers expect a record number of investor requests for refunds from crypto funds in November, up to $2 billion. The previous high of $1.3 billion was recorded in June after the Terra crash.

JPMorgan analysts also believe that the fall of major cryptocurrencies is not over, and the FTX bankruptcy crisis could lead to “cascading liquidations”. The market decline will continue for some time, reminiscent of the 2008 financial crisis. That being said, the JPMorgan team believes that the blow to total capitalization is likely to be less this time, as the TerraUSD episode has already caused a pullback in risk taking and a more wary attitude towards investing in dubious projects.

Edward Snowden, a former CIA and National Security Agency officer who had fled to Russia, said that after the collapse of FTX, the industry should switch to secure DEXs. Decentralized exchanges are an alternative to centralized exchanges and are managed solely by smart contracts without the participation of a third party. Thanks to full decentralization, DEXs in their original state should never face problems similar to FTX, as their reserves never fall below users' deposits.

At the time of writing, Friday evening November 18, bitcoin has stopped the fall caused by the collapse of FTX and is consolidating in the $ 16,550-16,650 area. Such a lull after the tsunami gave BTC supporters a vengeance to demonstrate their faith in its bullish future. Thus, MicroStrategy Executive Chairman Michael Saylor announced that he is not going to abandon his strategy of buying and accumulating digital gold. Tesla CEO and new Twitter owner Elon Musk is confident that BTC will survive the bear market, although it will take a long time before its full potential is realized. Robert Kiyosaki, author of Rich Dad Poor Dad, also expressed optimism, who said that he is not concerned about the current price movement of the main cryptocurrency.

A popular analyst named Dave the Wave joined the chorus of optimists. He acknowledged that the cryptocurrency markets are facing a huge loss of public confidence. But at the same time, he recalled that bitcoin had earlier remained in a long-term uptrend even when many announced its actual death. “Do not underestimate the speculative beast underlying the BTC market, as reflected in the LGC (logarithmic growth curve), which has demonstrated the ability to absorb the most terrible news and events,” Dave the Wave believes.

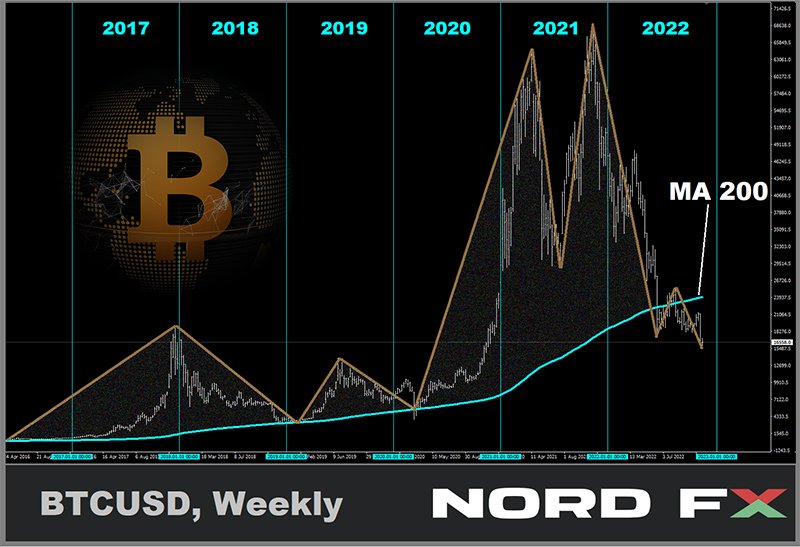

BTC/USD has already lost long-standing support in the form of the MA200 weekly moving average. However, experts from the analytical firm TradingShot conducted a fractal analysis, which did not rule out a powerful rally in the main cryptocurrency in 2023. In addition, its results suggest an increase in the bullish potential of the coin by 2024 and, possibly, its growth to $95,000.

Analyst Jason Pizzino opined that bitcoin bulls would not allow BTC to fall to $10,000. “We have a figure of $14,900 in the spot market as a cycle low and around $15,500 depending on which exchange you use.” According to Pizzino, “If we go above $18,500 or $18,600, that would be a strong indication that the whole thing was just a shake-up.” “However,” the trader added, “that doesn't mean that once we close above that $18,500, we can't go back down. We would then have a price of around $13,500, which is relatively well in line with the previous highs of the old 2019 cycle.”

Morgan Stanley bank experts do not exclude a new fall. In their opinion, if BTC fails to gain a foothold above $17,000, traders will soon switch to sales. The result, most likely, will be a fall in the BTC rate below $15,000. In the event of such a rollback, the cryptocurrency can only qualify for immediate support in the $14,000 region. Moreover, Morgan Stanley does not exclude that bitcoin will find the bottom at $13,500 or even $12,500. But that would be the worst of the scenarios.

Delphi Digital came to a similar conclusion. Its report says that market consolidation has been delayed and that technical indicators hint at a new reset by the end of November. At best, bitcoin will be able to stay in the range of $14,000 to $16,000.

At the time of writing, BTC/USD is trading in the $16,600 area, ETH/USD - $1,200. The total capitalization of the crypto market is $0.832 trillion ($0.860 trillion a week ago). The Crypto Fear & Greed Index for seven days has not been able to get out of the Extreme Fear zone and is at around 23 points.

Finally, a few tips from Jordan Belfort. Tip No.1: Invest in bitcoin for 3-4 years. “If you take a three-, four-, or five-year horizon, I would be shocked if you didn’t make money,” says this Wolf of Wall Street. Tip No.2: Don't look at anything other than bitcoin and Ethereum. Finally, Tip No.3: Don't panic. “The entire crypto world is paralyzed with fear. I will say that if you return to the game, now is the very moment when the most money is being made in the market.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

திரும்பிச் செல்லவும் திரும்பிச் செல்லவும்