First, a review of last week’s events:

- EUR/USD. The statement of the head of the US Federal Reserve Jerome Powell at the symposium in Jackson Hole is still the most discussed among investors and experts. The Fed decided to take the most serious step in monetary policy starting in 2012, announcing its plans to aim for an “average inflation rate of 2%.” This means that the regulator will not tighten its monetary policy even if the inflation rate exceeds these very two percent.

With his speech, Powell dealt another blow to the dollar, which has surrendered one position after another since March 20. The printing press launched by the Federal Reserve during the pandemic and the decrease in interest rates led to the fact that, starting from 1.0635, the pair EUR/USD rose above 1.2000 last week. During this period, the euro appreciated against the US currency by 13%, which is bad enough for the European economy.

Back in 2015-16, the then head of the ECB Mario Draghi introduced a policy of negative interest rates. This made it possible to lower the quotes of the single European currency to 1.0500, that is, almost to parity with the dollar. The weak euro contributed to higher inflation and economic growth in the EU, bolstered the eurozone's export potential, making its goods cheaper for the overseas consumer. However, in 2018, the euro went up again, rising to about 1.2000. Then, with great difficulty, it was lowered down again. And now we see 1.2000 again.

It is clear that in order to reverse the trend southward, the European regulator will have to resort to a very aggressive monetary policy. The importance of the exchange rate for the health of the Eurozone was announced this week by ECB Chief Economist Philip Lane. His remark allowed the dollar to strengthen a bit. However, we can expect the main events next week on Thursday, September 10, when the next meeting of the European Central Bank will take place. More on this in the second part of this article.

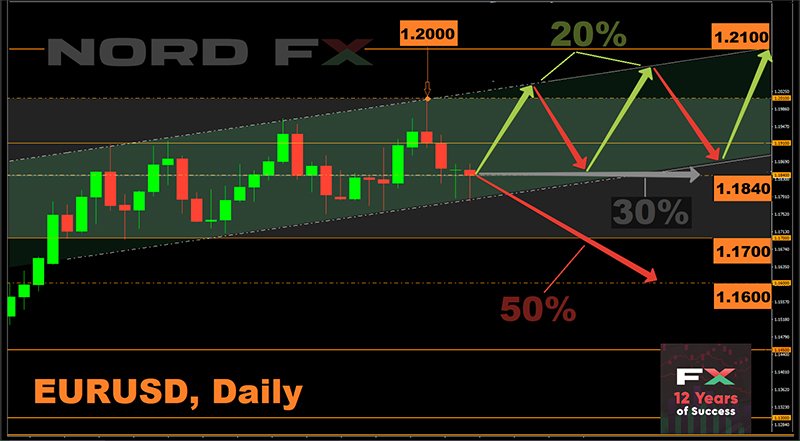

And now about the forecast given by experts for the past week. 60% of them felt that the pair EUR/USD would hold in the price range of 1.1700-1.1910. The remaining 40% voted for the breakdown of the upper border of the channel and the growth of the pair to the symbolic level of 1.2000. If you look at the chart, it becomes clear that both of them were right: the pair really reached the 1.2000 height. However, it could not gain a foothold there and quickly dropped to the 1.1780 horizon. The last chord of the five-day period was set at 1.1840. That is, the pair has been in a smoothly ascending channel with a width of about 200 points for the fifth week already, which allows us to say that the final trend reversal in favor of the dollar has not yet occurred; - GBP/USD. In general, the weekly chart of this pair follows the EUR/USD chart. The difference is that if the European currency eventually returned to the central part of the ascending medium-term channel, the pound did not do this, and ended the week near its upper border - at around 1.3275. However, the bulls did not manage to update the 2019 high of 1.3515. Their upward spurt was stopped at 1.3482;

- USD/JPY. Markets are still ruled by risk sentiment rather than macroeconomic indicators. Many investors expected that the publication of data on the US labor market on Friday, September 04, could affect the dynamics of the USD/JPY pair, however, nothing extraordinary happened: first, a slight increase by 30 points, and then a return to its original positions.

The forecast given by the majority of analysts (65%) spoke of the strengthening of the dollar and that the pair would not leave the corridor of 105.10-107.00. This is exactly what happened. Starting from Monday, the dollar rushed upward, reaching a height of 106.55 on Thursday and showing an increase of 120 points. As for the end of the trading session, the pair completed it at the level of 106.22; - cryptocurrencies. One of the richest people on the planet, Warren Buffett, has invested $6 billion dollars in shares of Japanese companies. Commenting on this move, renowned crypto enthusiast and TV presenter Max Kaiser said that Buffett is fleeing the dollar in this way, the depreciation of which will lead to a sharp rise in quotations of alternative assets such as gold and bitcoin.

Perhaps there is some logic in Kaiser's statement, however, gold, on the contrary, has fallen in price by 7%, and Bitcoin has not been able to overcome the $ 12,000 milestone over the past month, starting from August 7.

Our analysts predicted that the BTC/USD pair would move along Pivot Point $11,000 with one-off emissions up to $9,500 south and up to $12,800 north. It is this scenario that starts to come true. At the beginning of the week, the bulls went on another assault, but could hardly get to the height of $12,050. Miners, who, in anticipation of further growth, kept a record amount of cryptocurrency in their wallets, worth more than $ 20 billion (1.82 million BTC), began to sell it. The outflow of bitcoins from their wallets, according to CryptoQuant, amounted to over 1,500 BTC during the day from Wednesday to Thursday. Of course, this is not so much, but, as it turned out, it is quite enough for the bears to completely take over the market. As a result, the main cryptocurrency lost almost 17% in price, reaching $ 10,000, on Friday September 04. The dollar, growing contrary to Max Kaiser's forecasts, affected the collapse as well.

The total capitalization of the cryptocurrency market decreased from $ 360 billion to $ 334 billion in seven days. Moreover, it reached $ 393 billion at its peak on August 2, that is, the drop was 15% in just two days. The Bitcoin Fear & Greed Index dropped from 74 points to 40, and just like the RSI, it came out of the overbought zone.

The dominance of the main cryptocurrency in the market continues to decrease. If at the beginning of the year its capitalization was about 70%, now it has dropped to 58%. But the share of ethereum, on the contrary, is constantly growing, rising from 7.29% to 12.90%. ETH miners earned a record $17 million on September 01 due to the high demand for the blockchain of this project. Recall that the creator of ethereum, Vitalik Buterin, announced his blockchain as the basis for the operation of other cryptoservices this year, which aroused increased interest in this altcoin. However, returning to the events of the end of the last week, it should be noted that if the pair BTC/USD lost “only” 17%, the fall of ETH/USD at its peak exceeded 27%.

As for the forecast for the coming week, summarizing the views of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. As noted above, the ECB will need to start almost a war with the Fed in the area of monetary and fiscal policy in order to turn the pair down. Its outcome will depend on how far the EU and the US are prepared to go in their combat operations.

The forthcoming meeting of the ECB on Thursday, September 10, and the subsequent press conference of its head Christine Lagarde may give the market an idea of what potential the European regulator is ready to use in this war. Analysts at Bloomberg believe that the ECB could increase the program of emergency asset purchases by €350 billion by the end of 2020, and the volumes of other programs - by another €220 billion. Such expansion of European quantitative easing (QE), according to experts, is unlikely to benefit the banking system of the Old World (full of unclaimed money as is), but will be able to weaken the euro. The lower the cost of interbank borrowing goes, the greater the pressure on the common European currency will be.

However, it is not at all certain that the victory in this currency war will be on the side of Europe. According to a number of Reuters analysts, if the Fed continues to keep the interest rate close to zero, and the recovery of the Eurozone economy outstrips the recovery of the US economy, the EUR/USD rate may well rise to 1.2100.

In the meantime, the balance of power in the discussion of experts is the following: 50% of them expect that the pair will still be able to break through the support in the 1.1700 zone and go down at least another 100 points below. Another 30% of analysts believe it will move in the 1.1700-1.2010 trading range. And finally, the remaining 20%, supported by graphical analysis on D1, hope to see the pair storm the 1.2100 high by mid-September;

- GBP/USD. Just like the neighbors to the west and east - the US and the EU - one of the determining factors for the UK economy is overcoming the consequences of the COVID-19 crisis, and the measures that are being taken for this. The new Chancellor of the Exchequer, Rishi Sunak, who took office only this year, plans to roll back a series of stimulus measures as early as September, such as subsidies to restaurants. However, most likely, it will not have any strong influence on the British currency quotes. Moreover, the government intends to stick to plans for other QE programs for now.

The curtailment of the program for retaining employees on unpaid leave on October 31 may be much more significant for the market. Another important event is the EU Brexit Summit. But it will also take place only in mid-October, and a lot can change until then.

The majority of experts (60%) believe that the pound is already exhausted in its drive to the north, and the pair is waiting for a turn to the south. And, when moving from weekly to monthly forecast, the number of supporters of bears increases to 70%. The closest strong support is in the 1.3000 zone.

There is a red-gray-green multicolor among the technical indicators on H4, as in the case of EUR/USD. However, there is a noticeable advantage of the “green” ones on D1: there are 55% of those among oscillators and 80% among trend indicators.

As for the graphical analysis, it shows first the lateral movement of the pair in the corridor 1.3065-1.3385, then its drop to the zone 1.2900 and return to the level 1.3275. All of this can happen within the next 14 days. Further targets for the pair are 1.3480 and the 2019 high of 1.3515; - USD/JPY. If you look at the chart, you can see that, starting from the last ten days of February, the pair has been gradually consolidating around 106.00. Experts do not see any serious reasons for its going beyond the trading range of 105.10-107.00 at the moment. However, when switching to the monthly forecast, 65% of analysts are inclined to favor the bears. And if their prediction turns out to be correct, the pair could drop to the July 31 low of 104.18. In case of breakdown of the upper border of the channel, the nearest resistance will be the level of 107.50, the next one - 108.15;

- cryptocurrencies. The consequences of the activities of the US Federal Reserve System were so serious that even the leaders of such payment giants as Visa started talking about Bitcoin. At the end of August, after the statement of the head of the Fed, Jerome Powell, about the plans of his department, the DXY dollar index fell to a critically low level of 92.14. In response, Visa's Public Policy Director Andy Yee tweeted: “Jerome Powell's speech today will go down in history books. This is the first time I've seen such a small group steal so much from so many people. Save yourself with bitcoin."

However, it looks like the market is not yet ready to follow Mr. Yee's call. Most experts (60%) are inclined to believe that bitcoin may roll back to values below $10,000 in the near future. And, first of all, this will be associated with the restoration of investor interest in the dollar.

If bitcoin breaks through the $10,000 barrier, the pullback could drag on for months, according to analysts at financial company Crypterium. As a rule, the main coin feels uncertain in early autumn, but the drawdown gives a chance to start a new large-scale rally closer to the New Year.

The main forecast for the next week remains almost the same, with amendments of 500 points downwards: the BTC/USD pair will move along Pivot Point $10,500 with one-off emissions up to $9,000 south and up to $12,300 north.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

திரும்பிச் செல்லவும் திரும்பிச் செல்லவும்