Introduction

Among the many projects in the cryptocurrency world, Cardano has gradually earned a reputation as one of the most research-driven and carefully developed platforms. While it may not always attract the same level of headlines as Bitcoin or Ethereum, Cardano has steadily advanced its technology and expanded its ecosystem. It is not simply a digital currency; it is a blockchain designed for smart contracts, decentralised applications, and financial innovation.

In this article we will explore what makes Cardano unique, how it compares with another fast-rising blockchain, Solana, and why new developments such as staking instruments and decentralised finance (DeFi) applications make it worth watching for anyone involved in financial markets.

What Is Cardano?

Cardano is a third-generation blockchain project created in 2017 by Charles Hoskinson, one of Ethereum’s original co-founders. Its native cryptocurrency, ADA, is used to pay transaction fees and secure the network.

What sets Cardano apart is its scientific and peer-reviewed approach. Rather than rushing upgrades, the development team relies on academic research, formal verification, and gradual rollouts. Its consensus mechanism, Ouroboros, is a proof-of-stake (PoS) system designed to be more energy-efficient than proof-of-work blockchains like Bitcoin.

For traders and investors, this means Cardano is positioned as a scalable, sustainable platform that can support decentralised systems across many industries, from identity management to supply-chain tracking and, most importantly, financial markets.

Cardano vs. Solana: Different Paths to the Same Goal

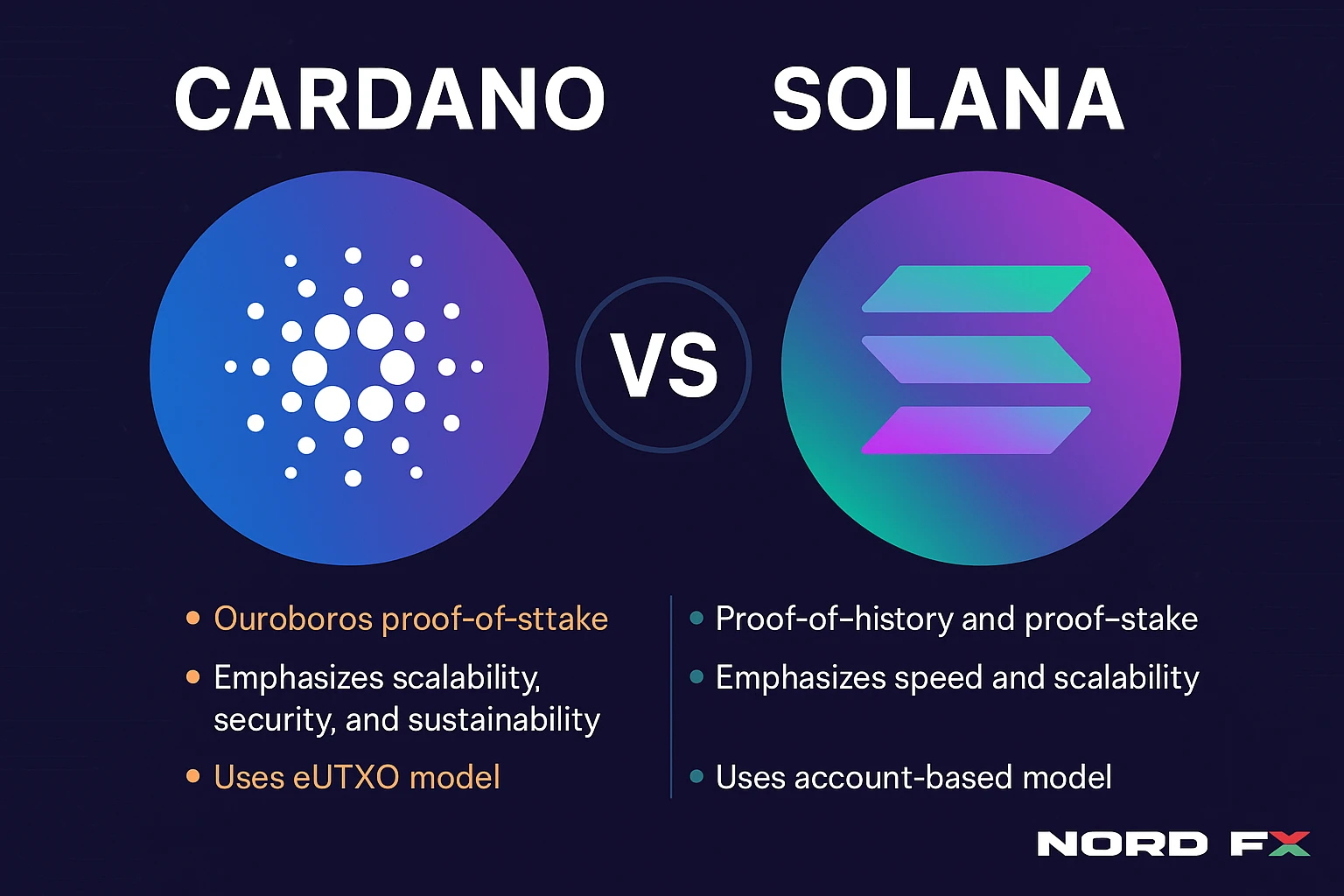

Cardano is often compared with Solana, another blockchain that has grown rapidly in recent years. Both aim to provide scalable alternatives to Ethereum, but they follow very different strategies.

- Solana prioritises speed and low transaction costs. Its design enables very high throughput, with thousands of transactions per second. This makes it attractive for decentralised exchanges and fast-moving applications. However, critics argue that its network has suffered from outages and that its speed comes at the cost of decentralisation.

- Cardano prioritises stability, research, and formal development. It is slower to roll out features but places more emphasis on security, decentralisation, and transparency. For example, it uses the extended unspent transaction output (eUTXO) model, which improves predictability and parallel processing of transactions, compared to Solana’s account-based approach.

For investors and developers, the choice between Cardano and Solana often depends on priorities. Solana may suit those looking for speed and innovation, while Cardano appeals to those who prefer reliability, governance, and a carefully tested foundation for smart contracts.

Cardano and DeFi: Smart Contracts in Action

One of the most important milestones for Cardano came in 2021 with the Alonzo upgrade, which enabled smart contracts on its blockchain. Since then, developers have built a growing range of DeFi applications on Cardano, from decentralised exchanges (DEXs) to lending protocols.

Smart contracts allow agreements to be executed automatically on the blockchain without intermediaries. On Cardano, these contracts benefit from the security of the Ouroboros consensus mechanism and the predictability of the eUTXO model. As a result, Cardano’s DeFi ecosystem is expanding steadily, with projects focused on:

- Decentralised exchanges (DEXs) for trading digital assets.

- Lending and borrowing platforms where users can earn interest or access liquidity.

- Identity and compliance solutions designed to connect DeFi with traditional financial markets.

While Cardano’s DeFi ecosystem is smaller than that of Ethereum or Solana, it has the advantage of being built on a strong research-driven foundation. This approach may appeal to institutional investors who require greater transparency and security in decentralised systems.

Staking and New Investment Instruments

Another important feature of Cardano is its staking mechanism. Holders of ADA can delegate their coins to staking pools and earn rewards in return. This not only provides passive income but also contributes to the network’s decentralisation and security.

In 2025, the introduction of the Cardano Staking ETP (CASL) on the Deutsche Börse marked a new step in institutional adoption. This exchange-traded product allows investors to gain exposure to ADA and staking rewards without directly holding or managing a blockchain wallet. For traditional investors, this lowers the entry barriers and integrates Cardano more closely into global financial markets.

The growing interest in such products shows that blockchain assets are increasingly being treated alongside futures, commodities, and higher-yielding currencies as part of diversified portfolios.

Outlook: Where Cardano Fits in the Future of Blockchain

Looking ahead, Cardano is set to continue evolving through its governance phase, known as Voltaire. This will give ADA holders a direct role in decision-making, making Cardano one of the most decentralised systems in practice as well as in theory.

Cardano’s strengths include its commitment to peer-reviewed research, its eco-friendly proof-of-stake system, and its gradual but steady adoption in areas such as DeFi, smart contracts, and identity solutions. Its challenges lie in competing with faster-moving ecosystems like Solana, Ethereum, and new entrants that can attract developers with speed and large user bases.

However, by focusing on transparency, reliability, and long-term sustainability, Cardano has carved out a distinct position in the blockchain sector. For traders and investors, this means Cardano remains a project to watch, both as a cryptocurrency and as a platform that may support the next wave of financial innovation.

Conclusion

Cardano is more than just another digital asset. It represents a carefully designed blockchain ecosystem that balances innovation with research and security. Its comparison with Solana highlights two very different approaches to the same challenge: building scalable, decentralised platforms for global use. With the rise of staking products like the Cardano Staking ETP and the expansion of its DeFi ecosystem, Cardano is moving closer to bridging the gap between blockchain technology and traditional financial markets.

For anyone following the development of smart contracts, decentralised systems, and financial markets in the digital age, Cardano deserves attention as one of the most ambitious and steadily advancing projects in the blockchain world.

Go Back Go Back