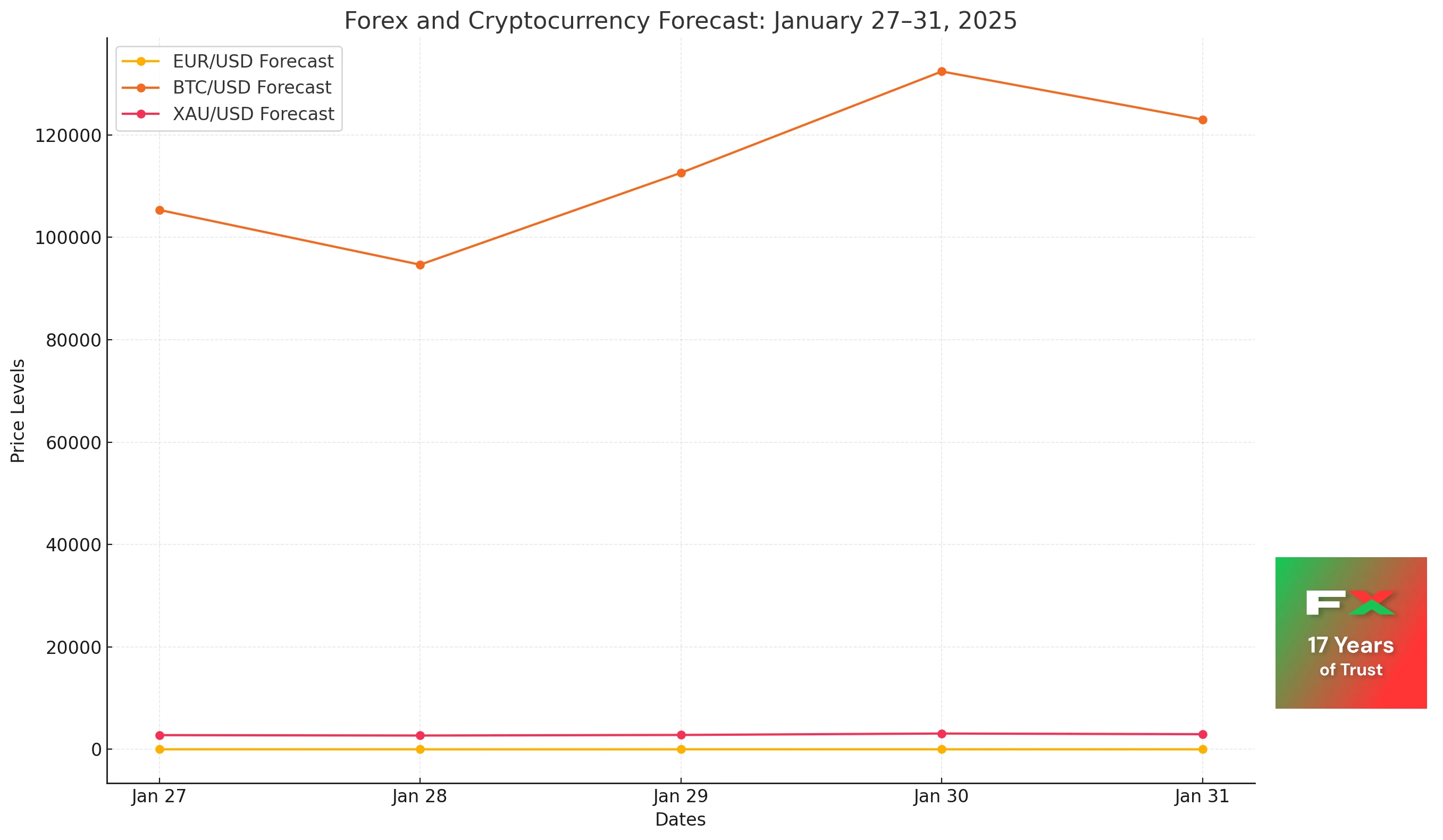

The past week in the financial markets has seen mixed movements across major currency pairs, cryptocurrencies, and commodities. The euro-dollar pair (EUR/USD) has been navigating a corrective phase, attempting to regain upward momentum after a brief dip. Bitcoin (BTC/USD) continued its bullish trend but showed signs of a potential short-term correction before further growth. Meanwhile, gold (XAU/USD) remains supported by buyers, consolidating gains with a bullish breakout in sight. As we approach the trading week of January 27–31, 2025, the market is expected to test significant support and resistance levels, with investors closely watching key indicators for directional cues.

EUR/USD

The euro-dollar pair (EUR/USD) ended the previous week near the 1.0486 mark, completing a correction phase while staying within a broader upward movement. Despite this, the pair has exited a descending channel, though moving averages indicate a bearish trend remains in play. Sellers have exerted pressure, signalling a potential continuation of the decline to test the support area around 1.0285. However, a rebound from this level is anticipated, potentially driving the pair upward toward the 1.0985 target in the coming week.

Technical indicators suggest an additional bullish signal, with a possible test of the relative strength indicator (RSI) support line. A breakout above 1.0545 would further confirm this scenario, strengthening the likelihood of continued growth. Conversely, a drop below 0.9935 would invalidate this outlook, suggesting a deeper decline toward 0.9645.

BTC/USD

Bitcoin (BTC/USD) concluded last week at 105,361, continuing its advance within a well-established bullish channel. Moving averages confirm an ongoing upward trend, and a break above signal lines indicates sustained buying interest. However, a brief pullback toward the support level at 94,665 may occur before the cryptocurrency resumes its ascent. A successful rebound from this support zone could propel Bitcoin toward a target above 132,405.

Support from technical signals includes a bounce off the lower boundary of the bullish channel and the RSI support line. A breakout above 112,605 would further validate the bullish trend. Should Bitcoin breach the 81,205 level instead, it would suggest a breakdown of support, with potential losses extending to 73,505.

XAU/USD

Gold (XAU/USD) ended the previous week trading near 2,772, maintaining its bullish trajectory within a “Triangle” pattern. Moving averages reflect strong buyer momentum, with a break above key signal lines reinforcing the possibility of further price increases. However, a short-term decline to test the 2,695 support level may occur before the commodity resumes its climb. A rebound from this support could drive gold prices toward a target above 3,085.

Additional support for a bullish outlook includes a bounce from the trend line on the RSI and a rebound from the upper boundary of the “Triangle” pattern. A breakout above 2,805 would further confirm the upward trend. Conversely, a drop below 2,495 would invalidate the bullish scenario, paving the way for a decline toward 2,415.

Conclusion

The trading week of January 27–31, 2025, holds potential for significant movements across the forex, cryptocurrency, and commodity markets. The euro-dollar pair could experience a rebound if support near 1.0285 holds, while Bitcoin and gold remain poised for further gains, albeit with possible short-term corrections. Traders should monitor key technical levels closely, as breakouts or breakdowns will play a crucial role in shaping market sentiment and guiding trading decisions.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.